Is it Allowed? Companies Face New Challenges with an Ever-Evolving List of “Off Limits” Ingredients in Cosmetic Products

Client Alert | 14 min read | 05.07.24

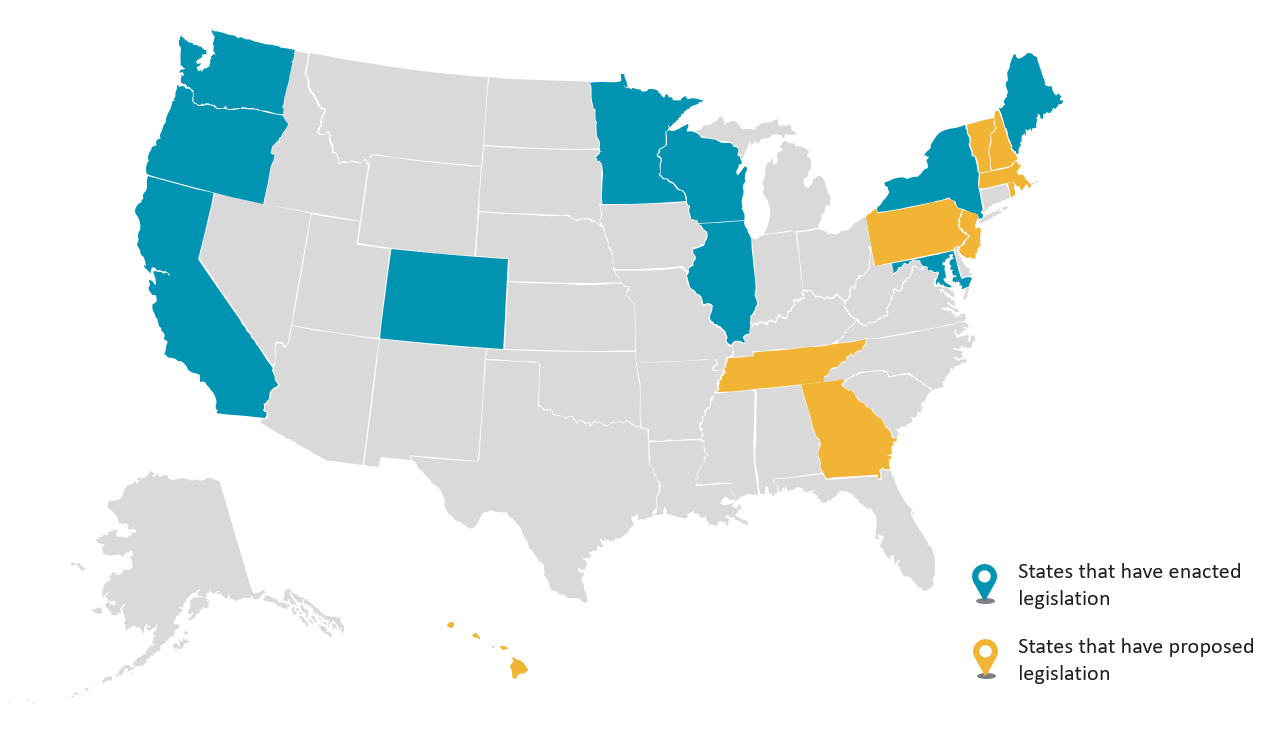

As we have previously discussed, in recent years, consumers have increasingly demanded “cleaner” beauty products and more transparency in product labeling. In addition to the FDA’s increased authority to regulate cosmetics under MoCRA, a number of states have now taken steps to regulate ingredients in cosmetics by limiting, and in some instances even banning, the use of certain ingredients that may be potentially harmful or toxic.

This web of complex and evolving regulations can be challenging for companies that manufacture and sell cosmetic products to track and follow to ensure compliance, especially when their products may be sold nationwide. Below is a May 2024 survey that may be helpful to companies in the process of untangling the current regulatory framework.

By way of background, the vast majority of states (39 of 50) have passed legislation that broadly prohibits (1) manufacturing and selling cosmetics that contain ingredients that allegedly can cause injuries and (2) providing false or misleading information on product labeling or packaging.[1]

Recent state legislation, however, goes one step beyond these regulations. As of May 1, 2024, the following states have enacted or proposed legislation limiting the manufacture, sale, and distribution of cosmetic products containing certain ingredients, including, but not limited to, chemicals like per- and polyfluoroalkyl substances (PFAS):

This recent legislation breaks down as follows:

|

ENACTED legislation banning or limiting use of PFAS in cosmetics |

PROPOSED legislation banning or limiting use of PFAS in cosmetics |

ENACTED legislation banning or limiting use of certain ingredients other than PFAS in cosmetics |

PROPOSED legislation banning or limiting use of certain ingredients other than PFAS in cosmetics |

|

|

|

|

Still unclear as to what is in and what is out? Our team has prepared a List of Banned Ingredients by State—a summary of the ingredients banned or restricted in each state, which we will monitor and update on a routine basis.

[1] States that have such legislation on the books include: Alabama, Alaska, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Vermont, Virginia, Washington, West Virginia, and Wyoming.

Contacts

Insights

Client Alert | 4 min read | 03.04.26

Sixth Circuit Finds EFAA Arbitration Bar to Entire Case — Not Just Sexual Harassment Claims

The United States Court of Appeals for the Sixth Circuit held, in an issue of first impression for that court, that the Ending Forced Arbitration of Sexual Assault and Sexual Harassment Act of 2021 (EFAA) renders an employer’s pre-dispute arbitration agreement unenforceable as to a plaintiff's entire lawsuit, whenever the lawsuit includes a viable sexual harassment claim.

Client Alert | 3 min read | 03.02.26

Client Alert | 4 min read | 03.02.26

Client Alert | 3 min read | 02.27.26