Tax – Got Tax Questions? Be a Squeaky Wheel

Publication | 02.27.19

[ARTICLE PDF]

It’s often said that there is opportunity in uncertainty. This is currently the case in the world of corporate taxation, where the Tax Cuts and Jobs Act of 2017 has created much confusion— and provided an opening for companies that aggressively pursue regulatory endorsement of their tax strategies. The TCJA is the most sweeping tax legislation since the Tax Reform Act of 1986. It significantly reduces the income tax rate for corporations, and it makes major changes related to the taxation of foreign income.

While it’s normal for tax laws—which are notoriously dense and arcane—to require clarification in the form of regulatory guidance, the TCJA stands out for its opacity. It was written largely by congressional Republicans behind closed doors, without any public hearings, and with considerable direct input from the business community. The rushed result was nearly 1,100 pages that many senators were unable to fully read and assess before the final vote. There were numerous typos, drafting errors, and provisions that raised more questions than they answered.

To date, the Internal Revenue Service has issued more than 150 guidance documents for the TCJA. Tax professionals say that this is only the beginning of what will ultimately be a mountain of guidance.

|

"The problem is that the TCJA isn’t clear about how to get this permission, and the IRS hasn’t yet provided guidance, which can leave companies in accounting limbo." |

“We’ll Get Back to You”

For an example of why guidance is necessary, look no further than section 451(b) of the Internal Revenue Code, which concerns revenue recognition and was established by the TCJA. Section 451(b) requires that companies using the accrual method of accounting (under which revenue can be recognized as income for taxation in a year different from the one in which it is received) recognize revenue no later than when it’s included in their financial reporting.

Sounds straightforward, right? According to Dwight Mersereau, a partner in Crowell & Moring’s Tax Group and a former advisor in the IRS’s Office of Chief Counsel, it isn’t. “Section 451(b) replaces the rule for timing of accrual revenue recognition that had been in place since 1939,” he says. “This seemingly simple provision has raised numerous questions from taxpayers trying to understand its requirements, such as whether ‘gains’ should be treated as ‘revenue.’ Other questions arise from taxpayers seeking relief from a literal reading of the statute, which could be interpreted as requiring a taxpayer to include an amount in income before the taxpayer has realized the income, such as when the taxpayer holds a security that has increased in value but hasn’t sold the security. In other words, section 451(b) cries out for clarification—like so much else in the TCJA.”

A major question raised by section 451(b) concerns changing a company’s method of accounting, i.e., from accrual to cash or vice versa. Companies that used accrual under pre-TCJA law must change their method to comply with the TCJA. As Mersereau explains it, “If companies want to change their method—which is a big deal—they need permission from the IRS commissioner. The problem is that the TCJA isn’t clear about how to get this permission, and the IRS hasn’t yet provided guidance, which can leave companies in accounting limbo.”

Possible Time Squeeze in Filing Returns

Another timing issue concerns the filing of corporate tax returns for calendar-year filers. Returns are due to the IRS by the following April 15, and many companies typically take advantage of the option for an extension of the deadline to October 15.

But the process for 2018 returns takes on added urgency as a result of the TCJA, notes Charles Hwang, a partner in Crowell & Moring’s Tax Group.

“It’s standard for companies to rely on IRS guidance in order to properly prepare their returns,” Hwang says. “And because preparing returns is complex and labor-intensive, they need these comments well ahead of when the returns are due. Since the TCJA is so confusing and there’s still a lot of guidance that hasn’t come out yet, more companies might find themselves in a time squeeze to file even by October 15.”

Hwang adds that while corporate tax departments and CFOs are well aware of this possibility, it might be news to general counsel and other senior executives. “Tax departments and outside counsel should make sure to alert GCs about this,” he says. “The increase in uncertainty may require additional resources or budget as well as SEC disclosure of certain issues.”

The IRS itself may also be an issue in the filing process. Congress has slashed the agency’s funding and staffing levels in recent years, including the imposition of a hiring freeze that started in 2010. So, at a time when taxpayers badly need IRS guidance to navigate the TCJA and properly file their returns, the agency is ill-equipped to handle the huge volume of inquiries that will come its way as filing deadlines approach.

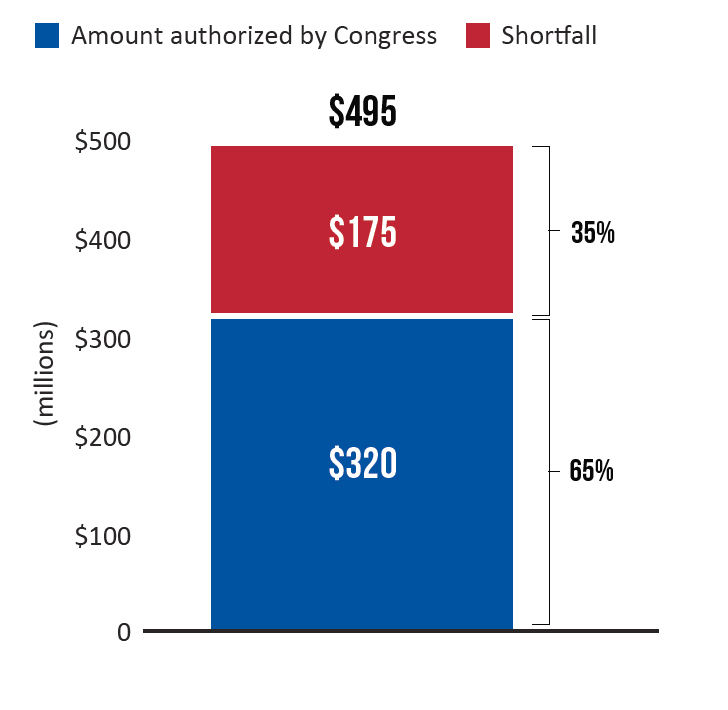

There’s some cause for optimism in this regard, as Congress appropriated $320 million in early 2018 to help the IRS address the new law, with much of it presumably to be used for additional hires. But observers point out that the IRS has said it will need $495 million over two years to implement the TCJA, meaning it’s been given only 65 percent of the money to do 100 percent of the work (see chart).

|

"Since the TCJA is so confusing and there’s still a lot of guidance that hasn’t come out yet, more companies might find themselves in a time squeeze to file even by October 15." |

The Bottom Line: Get Involved Early and Often

Mersereau and Hwang are urging organizations to be both proactive and persistent in engaging with the IRS and Treasury Department to address their TCJA questions. Squeaky wheels will get the grease, they say.

Many organizations already have embraced this approach, as there are numerous instances of companies using private meetings and/or public gatherings to raise issues that the IRS hadn’t thought of.

The following are specific steps companies can take to ensure that regulators are fully informed of their concerns:

- Meet directly, one on one, with the IRS and Treasury.

- Submit written comments in response to IRS and Treasury requests for feedback. Both entities encourage such comments and are eager to receive them.

- Participate in public hearings on TCJA-related topics. The IRS and Treasury welcome this, as well.

- “Play defense as well as offense” by monitoring guidance issued to other companies to see whether such guidance is relevant.

“Getting in front of the IRS and Treasury can only help companies get in front of their tax concerns,” says Mersereau. “Considering that millions or even billions are riding on regulatory interpretations, it’s critical that companies do everything they can to engage and communicate.”

65% of the Money for 100% of the WorkThe IRS needs $495 million over two years to implement the Tax Cuts and Jobs Act of 2017. But Congress has authorized only $320 million—just 65% of what’s needed. All the more reason for corporations to be aggressive as they seek IRS guidance on the TCJA.  |

Insights

Publication | 03.01.26

Publication | 02.19.26

The QICDRC Practice Direction on the Use of Artificial Intelligence

Publication | 02.06.26