Two Years After Proposal, SEC Finalizes Narrowed, But Still Controversial, Climate Change Disclosures Rule

Client Alert | 03.08.24

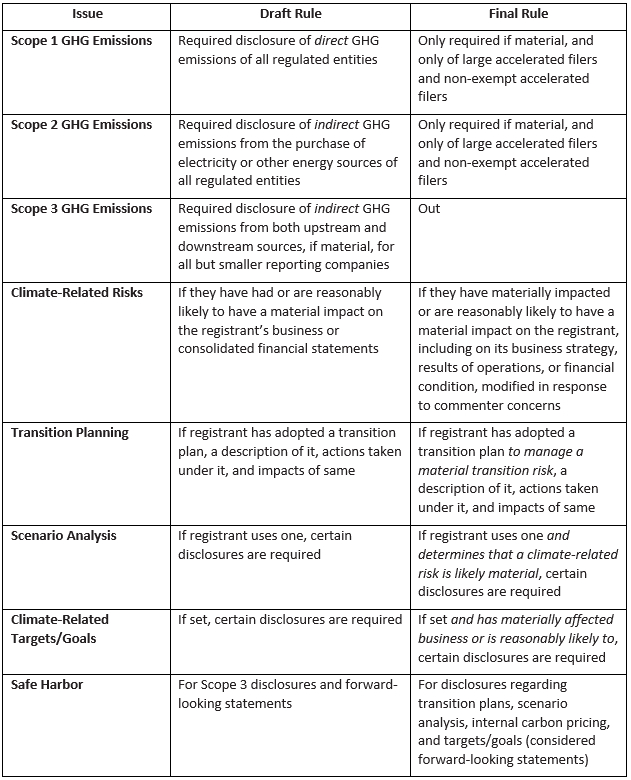

On March 6, 2024, the U.S. Securities and Exchange Commission (SEC) voted to finalize a rule that requires regulated issuers to disclose information regarding their greenhouse gas (GHG) emissions and other climate-related information. First proposed in 2022, the final rule has been scaled back in some significant ways from what was initially proposed. Notably, the final rule requires only large accelerated filers and non-exempted accelerated filers to disclose direct and energy-related (Scope 1 and 2)[1] GHGs—and only if such emissions are material to the business strategy, results of operations, or financial condition of a registrant—with no Scope 3 requirement to report on other indirect emissions (Scope 3). By comparison, the proposed rule would also have required Scope 1 and 2 emissions disclosures for all types of regulated entities regardless of materiality, and Scope 3 disclosures required of certain filers if material. The final rule reflects a heightened focus on materiality regarding disclosures of climate-related risks, and adjusts assurance requirements. It also extends the timing of GHG reporting, when required, to at least 2026 (for FY 2025 data) and phases in the assurance requirements. As soon as the SEC voted to finalize the rule, ten states (West Virginia, Georgia, Alabama, Alaska, Indiana, New Hampshire, Oklahoma, South Carolina, Virginia, and Wyoming) filed a petition for review in the Eleventh Circuit challenging the final rule.

While litigation has already started, companies within scope should evaluate now their readiness to comply if and when the rule goes into effect. They should also consider overlapping compliance obligations imposed by other recent disclosure requirements enacted in California and the European Union.

The final rule will go into effect 60 days after publication in the Federal Register and will include a phase-in compliance period that varies based on a public company registrant’s filing status (with a longer phase-in period for smaller reporting companies). Compliance with the final rules will begin with certain requirements for large accelerated filers beginning with the first annual report on Form 10-K for fiscal years beginning on or after January 1, 2025. Our review of the 886-page final rule is ongoing; to that end, we will continue to provide relevant analysis as that review proceeds. But in the meantime, below is a brief comparison of certain key elements of the proposal to the final rule (highly summarized) in chart form, and a high-level takeaway of what might come next.

Anticipated Implications

At bottom, new rules mean new disclosures. New disclosures can provide investors with greater transparency and more consistent information about publicly listed companies, as the SEC has aimed to do here. But such disclosures can also create more opportunities for regulated entities to provide materially misleading information. If they do, the SEC’s Enforcement Division has a Climate and ESG Task Force ready and waiting to look into those misstatements and police any perceived misconduct. Indeed, just recently Gurbir S. Grewal, Director of the Division of Enforcement, expressed the view that ESG is increasingly material to investors, and therefore it is crucial that when companies speak about ESG issues they do so truthfully. It is therefore vital that companies take the disclosures required under the new rule just as seriously as any others and plan for compliance, even if litigation subsequently alters the final rule’s scope.

[1] The final rules define the terms “Scope 1 emissions” (direct GHG emissions from operations that are owned or controlled by a registrant) and “Scope 2 emissions” (indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat, or cooling that is consumed by operations owned or controlled by a registrant).

Contacts

Insights

Client Alert | 3 min read | 03.02.26

Clinical trial sponsors and all other stakeholders involved in conducting commercial clinical trials of investigational medicinal products (IMP) in the UK.

Client Alert | 4 min read | 03.02.26

Client Alert | 3 min read | 02.27.26

Client Alert | 6 min read | 02.27.26