U.S. Imposes New Sanctions and Export Controls Targeting Russia and Belarus

Client Alert | 31 min read | 03.10.23

On February 24, 2023, the United States and other G7 nations announced a number of new sanctions and export control measures coinciding with the one-year mark of Russia’s military invasion of Ukraine. Shortly after these expansive sanctions and export controls were announced, the Departments of Justice (“DOJ”), the Treasury (“Treasury”), and Commerce (“Commerce”) issued their first-ever joint guidance regarding a planned crack-down by these agencies on sanctions and export controls evasion related to Russia in concert with DOJ’s sweeping announcements of a renewed focus on corporate compliance with sanctions and export controls.

We discuss these announcements in detail below.

New Sanctions and Export Controls-related Measures Imposed by the United States

New Designation Authority with Respect to the “Metals and Mining Sector”: Pursuant to Executive Order 14024 Section 1(a)(i), the Department of the Treasury’s Office of Foreign Assets Control (“OFAC”) added “metals and mining” to its list of sectors of the Russian Federation economy in which it can designate non-U.S. persons simply for “operat[ing] or hav[ing] operated in” those sectors (the “Metals and Mining Determination”). In simultaneously issued FAQs for the Metals and Mining Determination, OFAC defined the “metals and mining sector” to include “any act, process, or industry of extracting, at the surface or underground, ores, coal, precious stones, or any other minerals or geological materials in the Russian Federation, or any act of procuring, processing, manufacturing, or refining such geological materials, or transporting them to, from, or within the Russian Federation.”

OFAC’s guidance also clarifies that its Metals and Mining Determination “exposes persons that operate or have operated in an identified sector to sanctions risk; however, a sector determination does not automatically impose sanctions on all persons who operate or have operated in the sector.” This comes in contrast to determinations pursuant to Executive Order 14071 Section 1(a)(ii), which automatically prohibit U.S. persons from exporting, reexporting, selling, or supplying, directly or indirectly, certain categories of services to persons located in the Russian Federation.

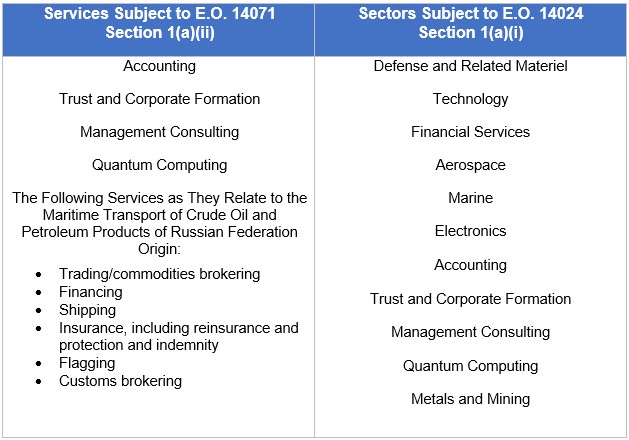

The chart below includes the current sectors, as of March 10, 2023, of the Russian economy subject to Section 1(a)(i) of E.O. 14024 and categories of services subject to Section 1(a)(ii) of E.O. 14071:

New SDN List Designations: OFAC designated 22 individuals and 83 entities on its Specially Designated Nationals and Blocked Persons List (“SDN List”). These designations included 12 Russian financial institutions (several of which were previously the subject of only more limited, list-based sanctions (aka “sectoral” sanctions)), as well as entities operating in Russia’s metals and mining sector, entities supporting Russia’s military capabilities, and entities involved in sanctions evasion.

Amended and Additional General Licenses: OFAC amended two existing general licenses and issued two new general licenses.

- General License 8F authorizes certain energy-related transactions with nine listed Russian financial institutions, including any entities directly or indirectly owned 50% or more by any of these financial institutions, or with the Central Bank of the Russian Federation (the “CBR”), through 12:01 a.m. eastern daylight time, May 16, 2023. OFAC amended this general license to cover two newly-designated Russian financial institutions, but did not extend the May 16, 2023 expiration date established in the previous version, General License 8E.

- General License 13D authorizes U.S. persons, and entities owned or controlled by U.S. persons, to continue to pay certain taxes, fees, or import duties, and purchase or receive permits, licenses, registrations, or certifications that would otherwise be prohibited by Directive 4 under Executive Order 14024, provided such transactions are ordinarily incident and necessary to their day-to-day operations in Russia until 12:01 a.m. eastern daylight time, June 6, 2023. OFAC amended this general license to again extend the expiration date, this time from March 7, 2023 to June 6, 2023.

- New General License 60 authorizes certain transactions ordinarily incident and necessary to the wind down of transactions with nine newly-designated Russian financial institutions, including any entities directly or indirectly owned 50% or more by one or more of these financial institutions, through 12:01 a.m. eastern daylight time, May 25, 2023. The general license also authorizes U.S. persons to reject, rather than block, transactions ordinarily incident and necessary to processing funds involving these entities.

- New General License 61 authorizes certain transactions ordinarily incident and necessary to the divestment or transfer, or the facilitation thereof, of debt or equity of six newly-designated Russian financial institutions, including any entities directly or indirectly owned 50% or more by one or more of these financial institutions, through 12:01 a.m. eastern daylight time, May 25, 2023.

New OFAC Guidance Regarding “Exit Taxes”: In FAQ 1118, OFAC addresses the fact that, “[a]s of December 2022, the Government of the Russian Federation may require a so-called ‘exit tax’ payment prior to the divestment of assets located in the Russian Federation, potentially involving the [CBR] and the Ministry of Finance of the Russian Federation.” Responding to the question of whether Russia-related General License 13D (described above) authorizes transactions that involve the payment of this so-called exit tax, OFAC answers “no.” Specifically, OFAC asserts that “[t]his so-called ‘exit tax’ is not considered ordinarily incident and necessary to day-to-day operations in the Russian Federation.” Because Directive 4 under E.O. 14024 prohibits U.S. persons from engaging in direct or indirect transactions involving the CBR or the Russian Ministry of Finance, OFAC states that U.S. persons whose divestment will involve an “exit tax” payment may require an OFAC specific license.

Export Control Amendments and Entity List Designations: The Department of Commerce’s Bureau of Industry and Security (“BIS”) also made a range of changes to its Russia- and Belarus-related export controls, and added a total of 89 entities to its Entity List. For additional details on these changes and designations, please read Crowell’s in-depth discussion in this article.

Joint Compliance Guidance

About a week after the announcement of these new measures, the Departments of Commerce, the Treasury, and Justice issued a joint statement entitled “Cracking Down on Third‐Party Intermediaries Used to Evade Russia‐Related Sanctions and Export Controls” (the “Joint Statement”). According to the associated press release, the Joint Statement is the first publication in a collective effort by these three agencies to inform the private sector about enforcement trends and provide guidance to the business community on compliance with U.S. sanctions and export control laws.

To assist the private sector with implementing appropriate compliance measures, this first installment highlights the tactics that have been used to evade sanctions and export controls targeting Russia. The agencies explain that one of the most common methods used to evade sanctions and export controls is the use of third-party intermediaries or transshipment points to disguise the involvement of individuals or entities targeted by Russia-related sanctions and export controls.

The Joint Statement emphasizes the importance of a compliance program that minimizes the risk of evasion, explaining that “[e]ffective compliance programs employ a risk-based approach to sanctions and export controls compliance” that is tailored to an organization’s size and risk profile. The statement further asserts that effective compliance programs should include “management commitment (including through appropriate compensation incentives), risk assessment, internal controls, testing, auditing, and training.” Although not explicitly referenced in the Joint Statement, this language generally tracks OFAC’s A Framework for OFAC Compliance Commitments, which OFAC previously issued as guidance regarding its expectations for sanctions compliance programs.

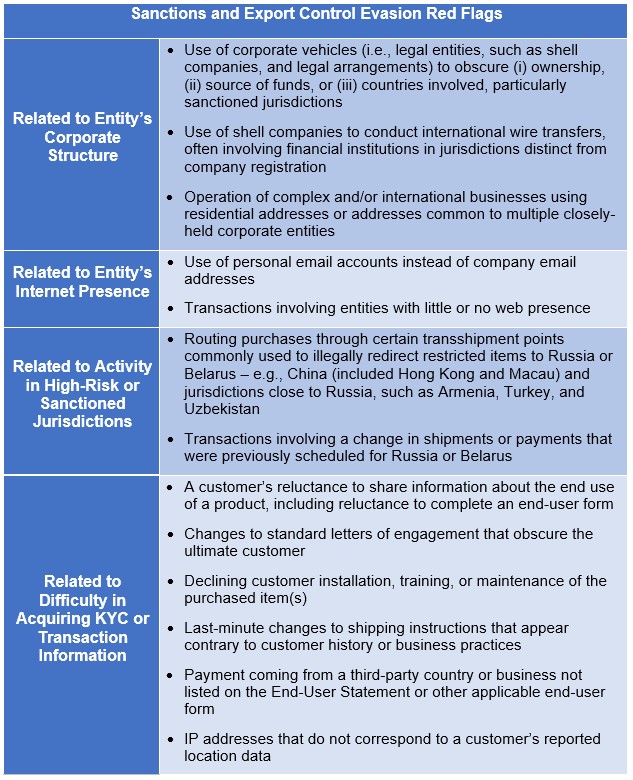

In addition, the Joint Statement outlines 13 common red flags that can indicate that a third-party intermediary may be engaging in efforts to evade sanctions or export controls. While the Joint Statement does not categorize them, the red flags can be loosely organized into four categories based on the types of information on which they focus:

The Joint Statement recommends the following steps as best practices for mitigating risk associated with Russia-related sanctions and export control evasion:

- screening current and new customers, intermediaries, and counterparties through the Consolidated Screening List and OFAC Sanctions Lists;

- conducting risk-based due diligence on customers, intermediaries, and counterparties;

- regularly consulting guidance and advisories from the Treasury and Commerce to inform and strengthen a company’s compliance program; and

- reviewing BIS and OFAC enforcement and targeting actions, as well as criminal charges pursued by the Department of Justice, as they often reflect certain tactics and methods used by intermediaries engaging in sanctions and export control evasion.

The Joint Statement builds on agencies’ prior collective efforts to focus on evasion, including the first-of-its kind joint alert issued by BIS and the Financial Crimes Enforcement Network (“FinCEN”).

Sanctions Are the New FCPA

The Joint Statement between DOJ, Commerce, and Treasury marks the first of many, according to March 2, 2023 remarks made by DOJ’s Deputy Attorney General (“DAG”) Lisa Monaco at the American Bar Association National Institute on White Collar Crime. Moving forward, the three agencies will issue joint advisories similar to the Foreign Corrupt Practice Act (“FCPA”) guidance that DOJ has routinely published jointly with the Securities and Exchange Commission (“SEC”), to inform the private sector about enforcement trends and to convey the Department’s expectations as to national security-related compliance.

In those remarks, the DAG also announced a surge of resources at DOJ to address the intersection of corporate crime and national security, emphasizing the Department’s reinvigorated focus on corporate compliance with sanctions and export controls. Underscoring that “[w]hat was once a technical area of concern for select businesses should now be at the top of every company’s risk compliance chart,” the DAG outlined specific actions that demonstrate DOJ’s commitment to combatting corporate crime in the national security space: (1) the addition of 25 new prosecutors in DOJ’s National Security Division (“NSD”) who will investigate and prosecute sanctions evasion, export control violations and similar economic crimes; (2) the appointment of NSD’s first-ever Chief Counsel for Corporate Enforcement; (3) routine joint statements from DOJ, the Treasury, and Commerce regarding national security-related enforcement compliance, as noted above; and (4) a substantial investment in the Bank Integrity Unit (“BIU”) in the Criminal Division’s Money Laundering and Asset Recovery Section, which has a track record of prosecuting global financial institutions for sanctions violations. These actions are in addition to the recently announced Disruptive Technology Strike Force (“DIS-Tech Strike Force”) to be co-led by NSD and BIS.

While the DAG’s statements last spring following Russia’s invasion of Ukraine that “sanctions are the new FCPA” underscored DOJ’s commitment to enforcing sanctions and export controls, these latest announcements signify that corporate compliance in the export controls and sanctions arena will be at the top of DOJ’s enforcement priorities. Taken together, these collective actions signify a renewed collaboration across U.S. agencies to hold accountable those companies that fail to comply with sanctions and export controls, and underscore the need for companies—with or without a U.S. presence—to continue to prioritize compliance.

Contacts

Partner

He/Him/His

- Washington, D.C.

- D | +1.202.624.2500

- Washington, D.C. (CGA)

- D | +1.202.624.2548

- Boston

- D | +1.781.795.4700

Insights

Client Alert | 3 min read | 02.27.26

On February 17, 2026, the U.S. Equal Employment Opportunity Commission (EEOC) filed a complaint against Coca-Cola Beverages Northeast, Inc., in the United States District Court for the District of New Hampshire, alleging that the company violated Title VII of the Civil Rights Act of 1964 (Title VII) by conducting an event limited to female employees. The EEOC’s lawsuit is one of several recent actions from the EEOC in furtherance of its efforts to end what it refers to as “unlawful DEI-motivated race and sex discrimination.” See EEOC and Justice Department Warn Against Unlawful DEI-Related Discrimination | U.S. Equal Employment Opportunity Commission.

Client Alert | 6 min read | 02.27.26

Client Alert | 4 min read | 02.27.26

New Jersey Expands FLA Protections Effective July 2026: What Employers Need to Know

Client Alert | 3 min read | 02.26.26