GAO’s Bid Protest Sustain Rate Soars, but Is There a Catch?

Client Alert | 24 min read | 11.06.23

On October 26, 2023, the U.S. Government Accountability Office (GAO) released its Annual Report on Bid Protests for Fiscal Year 2023.

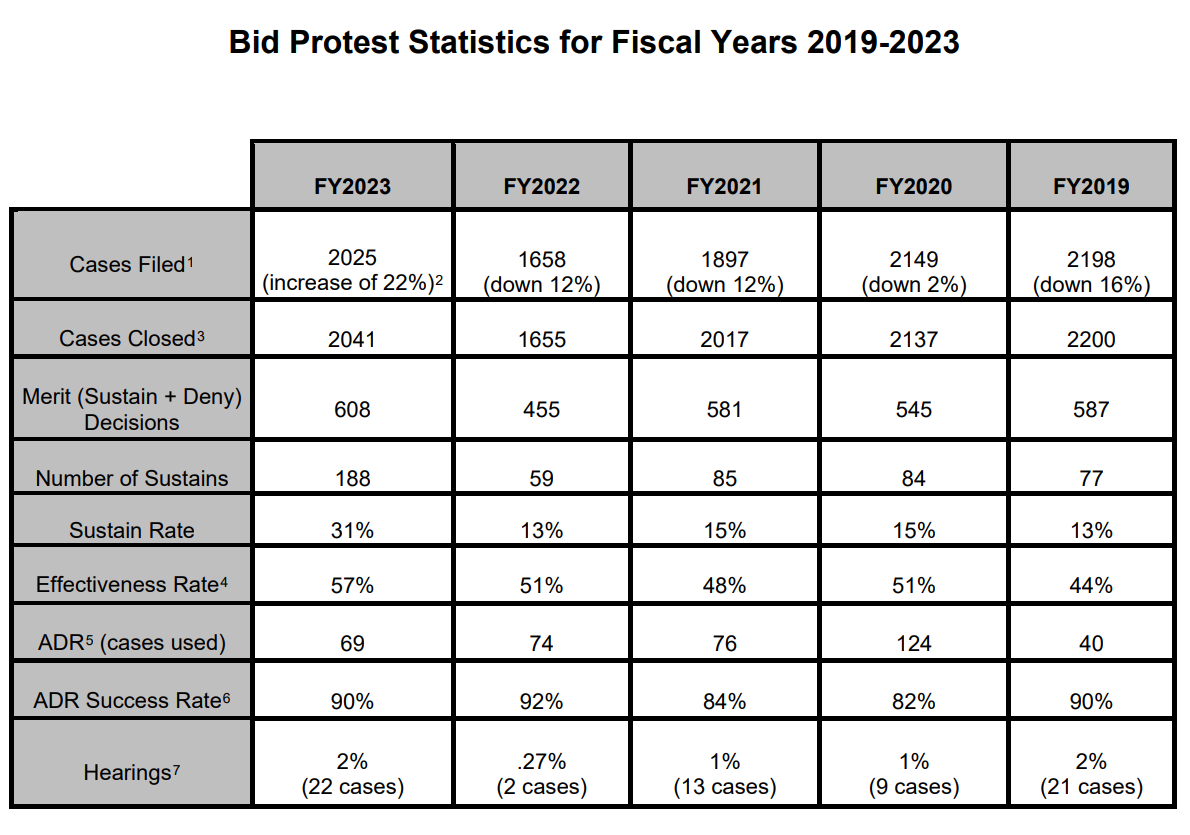

The total number of protests filed and the number of protests sustained by GAO increased significantly compared to Fiscal Year 2022—and GAO’s “Sustain Rate” jumped to 31%. GAO downplayed these increases to a degree, highlighting that it received “an unusually high number of protests challenging a single procurement”—the Department of Health and Human Services’ award of Chief Information Officer-Solutions and Partners 4 (CIO-SP4) government-wide acquisition contracts—which resulted in over 100 sustained protests. Nonetheless, even excluding the CIO-SP4 protests, it appears that GAO’s “Effectiveness Rate” (the percentage of cases in which the protester received relief, such as voluntary corrective action or a GAO sustain) was comparable to prior years—at or near 50%. Thus, bid protests remain an important oversight mechanism for the federal procurement system.

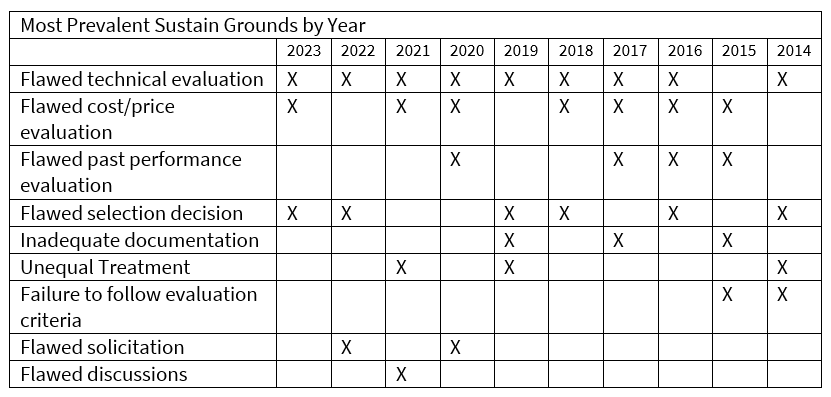

The most prevalent grounds upon which GAO sustained protests in FY 2023 were (1) unreasonable technical evaluations; (2) flawed selection decisions; and (3) unreasonable cost or price evaluations. The most prevalent grounds for sustained protests over the past ten years are detailed in the table below:

GAO’s full statistics for FY 2023 are shown below:

Contacts

Insights

Client Alert | 4 min read | 03.05.26

The U.S. Department of Labor (DOL) has proposed another revision to independent contractor regulations, one that would provide for more leeway in classifying workers as contractors. DOL’s proposed rule, published on February 26, 2026, would rescind the Biden DOL’s March 2024 independent contractor regulation and reinstate a framework substantially tracking the prior Trump rule of January 2021. The proposed rule would also apply the narrower analysis to worker classifications under the Family and Medical Leave Act (FMLA) and the Migrant and Seasonal Agricultural Worker Protection Act (MSPA). The comment period closes in late April 2026; until then, the 2024 rule remains in effect for purposes of private litigation.

Client Alert | 8 min read | 03.05.26

Client Alert | 4 min read | 03.04.26

Sixth Circuit Finds EFAA Arbitration Bar to Entire Case — Not Just Sexual Harassment Claims

Client Alert | 3 min read | 03.02.26