FinCEN Proposes Delaying Some Beneficial Ownership Filing Deadlines and Releases Additional Guidance for Beneficial Ownership Information Reporting

Client Alert | 16 min read | 10.03.23

In advance of the impending January 1, 2024 effective date for the U.S. Treasury Department, Financial Crimes Enforcement Network’s (“FinCEN’s”) beneficial ownership information (“BOI”) reporting requirements, FinCEN has proposed an extension of the reporting deadline for some reporting companies, and issued additional guidance regarding BOI reporting requirements, including a Small Entity Compliance Guide, a BOI Brochure, and supplementary Frequently Asked Questions (“FAQs”).

The NPRM’s Proposed Extension of Filing Deadlines

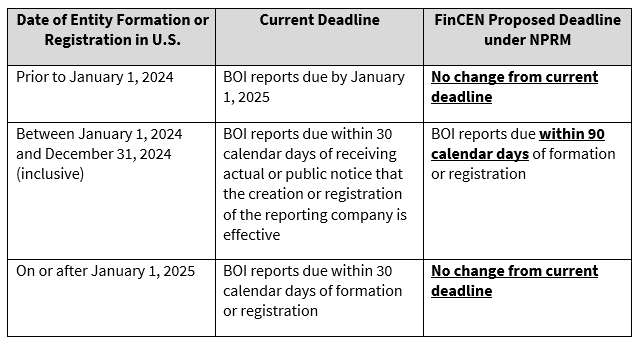

Under the current rule, reporting companies created or registered on or after January 1, 2024 will have 30 days from the date they are formed or registered to do business in the United States to file their BOI reports, and companies formed or registered to do business in the United States before January 1, 2024 will have until January 1, 2025 to file. However, FinCEN issued a Notice of Proposed Rulemaking (“NPRM”) on September 28, 2023, which proposes to extend the filing deadline to 90 days after formation or registration for those reporting companies created or registered on or after January 1, 2024, but before January 1, 2025. Companies formed or registered after January 1, 2025 would retain the existing obligation to file 30 days after formation or registration. FinCEN has said that the proposed extension for companies formed or registered during the first year of implementation of the rule is intended provide companies additional time to digest new reporting obligations and gather the requisite information for their BOI submissions. The comment period on the NPRM closes October 30, 2023. If adopted, the deadlines would change as follows:

FinCEN’s Additional Guidance

On September 18, 2023, FinCEN issued a Small Entity Compliance Guide designed to assist small businesses with their reporting requirements. Included in the Small Entity Compliance Guide are charts to aid a company’s determination of whether it qualifies as a “reporting company,” checklists regarding the applicability of any of the 23 exemptions to the definition of reporting companies, and suggested steps for determining beneficial owners.

The BOI Brochure provides a short primer of who must report BOI, and when and how these reports must be made.

The most important document for many potential reporting companies will be the three-dozen new FAQs that FinCEN has issued, which address a variety of topics. Some of the key FAQs include (1) D.7, which explains that where an entity’s beneficial owner holds their ownership interests exclusively through multiple exempt entities, they may report the name of each of the exempt entities instead of the individual beneficial owner’s information; (2) D.9, explaining that a member of the board of directors is not automatically a person exercising “substantial control” and must be assessed on a case-by-case basis to determine if that person qualifies as a “beneficial owner”; (3) E.3, which addresses when lawyers and accountants, including third-party providers, may qualify as “company applicants” that must be reported on; (4) G.2, which notes that parent companies cannot file a single BOI report for all of their non-exempt subsidiaries, and that each company that meets the definition of a “reporting company” must file its own report; (5) H.2, explaining events that would trigger the need to file an updated report; (6) J.1, which explains what reporting companies must do if they become exempt after filing a report; (7) K.1, providing some forbearance against enforcement for companies that correct inaccurate information within 90 days of filing a report; and (8) N.1, explaining that reporting companies may use third-party vendors to assist them in preparing their reports.

Current Status of BOI Reporting Procedure

FinCEN will start accepting BOI reports on January 1, 2024. The Beneficial Ownership Secure System (“BOSS”), which will house the reports, will not accept submissions before that date.

In the interim, FinCEN continues to work on the structure and procedure of BOI reporting. On September 29, 2023, FinCEN issued a Notice of Information Collection (“NOIC”), which outlines the proposed format for BOI submissions. FinCEN proposes in that notice to consider BOI reports that do not contain all required information as “incomplete and non-compliant filings.” Per the NOIC, reporting forms “will only be considered complete and compliant once the missing information is subsequently added.”

FinCEN is accepting comments on the NOIC until October 30, 2023.

Key Takeaways

Given the broad scope of FinCEN’s proposed rules, entities incorporated in the United States and foreign companies registered there should review FinCEN’s current BOI rules and guidance to understand if the rules apply to them, considering any possible exemptions. To the extent the rules do apply, the subject entities should begin the process of understanding how to collect BOI, and from whom. Although the deadline, especially for companies already incorporated or registered in the United States, may seem a ways off, companies will need to plan for time to figure out which entities in their structure must report, what information must be collected, how the company will get the information, and whether it needs legal advice on interpreting specific exemptions or requirements. This can quickly become a substantial exercise in project management for companies with many affiliates. Multinational corporations, private equity firms, and joint ventures in particular should consider consulting with counsel to determine whether any exemptions apply.

Companies formed or registered in New York should also be separately aware of the LLC Transparency Act, which was recently passed by New York legislators. The LLC Transparency Act – applicable to limited liability companies formed or registered under New York laws – largely mirrors the BOI reporting requirements laid out by FinCEN with one major difference: the reported information will be publicly accessible.

Crowell & Moring will continue to monitor developments with both FinCEN’s BOI reporting requirements and the LLC Transparency Act, and will provide further updates as appropriate.

Contacts

Insights

Client Alert | 4 min read | 02.20.26

SCOTUS Holds IEEPA Tariffs Unlawful

On February 20, 2026, the Supreme Court issued a pivotal ruling in Trump v. V.O.S. Selections, negating the President’s ability to impose tariffs under IEEPA. The case stemmed from President Trump’s invocation of IEEPA to levy tariffs on imports from Canada, Mexico, China, and other countries, citing national emergencies. Challengers argued—and the Court agreed—that IEEPA does not delegate tariff authority to the President. The power to tariff is vested in Congress by the Constitution and cannot be delegated to the President absent express authority from Congress.

Client Alert | 7 min read | 02.20.26

Section 5949 Proposed Rule Puts the FAR Council's Chips on the Table

Client Alert | 5 min read | 02.20.26

Trump Administration Pursues MFN Pricing for Prescription Drugs

Client Alert | 4 min read | 02.19.26

Proposed NY Legislation May Mean Potential Criminal Charges for Unlicensed Crypto Firms