Executive Order and Rulemaking on U.S. Outbound Investment

What You Need to Know

Key takeaway #1

Issuance of Executive Order and Rulemaking: On August 9, 2023, President Biden issued a long-anticipated “Executive Order on Addressing United States Investments in Certain National Security Technologies and Products in Countries of Concern” (the “Executive Order”). The Executive Order, which the President issued pursuant to the International Emergency Economic Powers Act (“IEEPA”), authorizes the U.S. Department of the Treasury (“Treasury”), in consultation with the U.S. Department of Commerce and other relevant agencies, to establish a new and targeted national security program aimed at certain outbound investments.

Key takeaway #2

Opportunity to Influence Regulations: The Executive Order instructs Treasury to promulgate outbound investment regulations, and Treasury simultaneously issued an Advance Notice of Proposed Rulemaking (“ANPRM”) seeking comments, until September 28, 2023, on such key issues as what transactions and technologies should be covered. Treasury will then publish a proposed rule soliciting additional comments before publishing a final rule. Each step provides industry a meaningful opportunity to shape the final set of regulations.

Key takeaway #3

No Currently Effective Restrictions: The Executive Order itself does not impose any restrictions; rather, the applicable restrictions will take effect only after Treasury publishes final regulations. Moreover, Treasury’s ANPRM notes that the final regulations will not apply to any historic “covered transactions” (though Treasury has said that it may inquire about transactions completed or agreed to after issuance of the Executive Order for purposes of developing the program).

Key takeaway #4

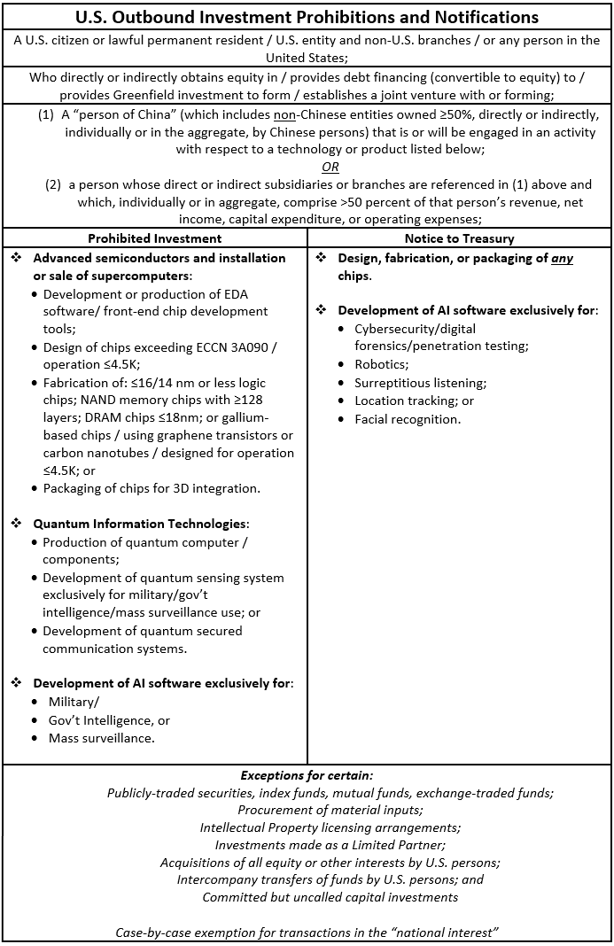

Not a “Reverse CFIUS”, but Prohibitions and Notifications: Some transactions will be outright prohibited, while others will only require a notification to Treasury, both based on the specific technologies involved. Unlike CFIUS, which applies to inbound investments in the U.S., there will not be a case-by-case review process. However, similar to CFIUS, Treasury will have the authority to nullify, void, or otherwise compel the divestment of any prohibited transaction.

Key takeaway #5

Third Technology-Focused Legal Regime for China: Currently, the People’s Republic of China (including Hong Kong and Macau) (hereinafter “China”) is the only “country of concern” targeted by the Executive Order. Treasury proposes to control a broad scope of activity related to the following technologies: (1) semiconductors and microelectronics, (2) quantum information technologies, and (3) artificial intelligence (AI) systems. The identified categories of technologies do not mirror those already controlled for China under existing U.S. export controls, or the clawback provisions of the CHIPS Act. Investors and other actors would need to review at least three separate technology-focused legal regimes to ensure compliance.

Key takeaway #6

U.S. Person Jurisdictional Hook: The prohibitions and notification requirements will apply to U.S. persons, and employ a similar definition to that used in U.S. economic sanctions. In addition, based on Treasury’s ANPRM, U.S. persons will have certain obligations with respect to non-U.S. entities that they control and in certain scenarios where U.S. persons knowingly direct transactions by non-U.S. persons.

Key takeaway #7

Potential Exceptions and an Exemption: Treasury has proposed various carveouts or exceptions for specific types of transactions, such as investments into publicly-traded securities or into exchange-traded funds, as well as a case-by-case “national interest exemption” for otherwise prohibited transactions.

Client Alert | 18 min read | 08.16.23

Proposed U.S. Outbound Investment Regulations

The Outbound Investment Program will be implemented through regulations issued by Treasury that will require notification for, or will otherwise prohibit U.S. persons from undertaking, certain transactions involving “covered national security products or technologies” and entities connected to a “country of concern.” Accordingly – concurrent with the Executive Order – Treasury released an Advance Notice of Proposed Rulemaking that provides some potential definitions of these terms, but the exact definitions and the details of the regulations will be developed through public notice and comment that concludes on September 28, 2023. Treasury also published a Fact Sheet that provides additional information on the proposed details and scope of the outbound investment prohibitions and notification requirements, which will likely not be finalized until 2024 sometime after Treasury has published draft regulations and gathered another round of public comments.

Discussions on restricting outbound investment have occurred since Committee on Foreign Investment in the United States (“CFIUS”) reform was implemented, and recent actions – like the investment prohibitions in the Office of Foreign Assets Control (“OFAC”)’s Chinese Military Industrial Complex Companies (“CMIC”) Program, the clawback provisions from the CHIPS Act, and the expansion of controls on semiconductor exports to China in October 2022 – previewed some of the U.S. government’s top concerns. Below is a more detailed summary of the ANPRM’s proposals, including: who the regulations cover, the transaction prohibitions and notification requirements, and what technologies and products are covered.

What Transactions Do the New Controls Cover?

U.S. persons are either prohibited from engaging in, or must provide notification to Treasury of, any “covered transaction” related to a “covered foreign person” (that is not an otherwise “excepted transaction”) and that involves a “covered national security technology or product.” In the ANPRM, Treasury proposes including the following definitions and scoping in its final regulations. It seeks input on 83 questions covering a variety of topics, including these definitions of key terms, as well as the scope of covered technology and products, and the anticipated burden of compliance with the proposed regulations.

- U.S. Person: This term includes U.S. citizens and lawful permanent residents, U.S. entities and their non-U.S. branches, and any person in the United States. This definition, which mirrors the one OFAC uses for its sanctions’ programs, does not include non-U.S. subsidiaries of U.S. entities. That said, the ANPRM contemplates imposing on any U.S. person certain obligations with respect to any non-U.S. entity that the U.S. person “controls,” with “control” defined to mean ownership, directly or indirectly, of 50% or more. Also, in certain scenarios, U.S. persons would be prohibited from “knowingly directing transactions” by non-U.S. person, with “knowingly” and “directing” having their own definitions.

- Covered Transaction: This term includes:

-

- (1) Acquisition of an equity (or contingent equity) interest in a covered foreign person;

- (2) Certain debt financing transactions that are convertible to equity;

- (3) Greenfield investment that could result in the establishment of covered foreign person; or

- (4) Establishment of a joint venture, wherever located, formed with a covered foreign person or could result in the establishment of a covered foreign person.

-

- Covered Foreign Person:

-

- This term includes any “(1) person of a country of concern that is engaged in, or… that a U.S. person knows or should know will be engaged in, an identified activity with respect to a covered national security technology or product; or (2) a person whose direct or indirect subsidiaries or branches are referenced in item (1) and which, individually or in the aggregate, comprise more than 50 percent of that person’s consolidated revenue, net income, capital expenditure, or operating expenses.” Currently, the only identified “country of concern” is China (which includes Hong Kong and Macao).

- Moreover, the term “person of a country of concern” mean any non-U.S. person who is also (1) a citizen or permanent resident of China, (2) a Chinese entity due to incorporation or headquarters, (3) the Chinese government (including its agencies and state-owned entities), (4) or any entity owned individually or in the aggregate, directly or indirectly, 50 percent or more by a person in (1)-(3). Notably, this proposed definition of “person of a country of concern” captures non-Chinese entities owned 50% or more, directly or indirectly, by one or more Chinese persons.

-

- Covered National Security Technologies or Products: The table above describes the proposed technologies to be covered. Significantly, these proposed technology categories generally do not mirror those in other existing and proposed controls over activities involving China, including under the U.S. Export Administration Regulations end use/end user controls, or those proposed by Commerce to implement the CHIPS Act national security guardrails.

- Prohibition, Notification, and Enforcement:

-

-

- As depicted in the table above, certain more advanced semiconductors and microelectronics, quantum technologies, and AI systems will be subject to prohibitions, while certain less advanced semiconductors/microelectronics and AI systems (but not quantum technologies) will be subject to a notification requirement. Any required notification would be filed within 30 days of closing and could be filed via Treasury’s online portal.

- If a prohibited transaction occurs, or a required notification was not filed (or was filed with material misstatements or omissions), then Treasury can impose penalties pursuant to IEEPA, the statute that is the basis for the vast majority of OFAC’s various economic sanctions programs. Currently, penalties are approximately $356,000 per violation or twice the value of the transaction, whichever is greater, and any willful activity can be referred to the U.S. Department of Justice criminal violations (which can be up to $1 million per violation, or twice the value of the transaction).

- Treasury has the authority to nullify, void, or otherwise compel the divestment of any prohibited transaction entered into after the effective date of the final regulations.

-

-

- Excepted and Exempted Transactions: Treasury is considering a number of exceptions and an exemption. Some of the more notable exceptions include:

-

-

- Publicly-traded securities, index funds, mutual funds, exchange-traded funds;

- Certain investments made as a Limited Partner;

- Committed but uncalled capital investments; and

- Intracompany transfers of funds.

-

-

In addition, the ANPRM proposes a case-by-case exemption for any otherwise prohibited transaction that “(i) provides an extraordinary benefit to U.S. national security; or (ii) provides an extraordinary benefit to the U.S. national interest in a way that overwhelmingly outweighs relevant U.S. national security concerns.”

Now What?

Provide Feedback to Treasury

Interested members of the public have until September 28, 2023 to file comments in response to the ANPRM.

Further U.S. Government Action

Congress has debated the need for legislation concerning certain outbound investments to China since 2018. While Congress has not settled upon a legislative approach, it anticipated the current Executive Order through the Consolidated Appropriations Act of 2023. Signed into law by President Biden in December 2022, the Act required the Departments of Treasury and Commerce to submit reports on the establishment of an outbound investment screening mechanism and associated costs. The reports were submitted to Congress on March 7, 2023.

The Senate recently approved the Outbound Investment Transparency Act, its own version of outbound investment screening, but this bill only includes notice requirements though across a broader range of technology sectors including satellite-based communications, network laser scanning systems, and other export-controlled technology. Whether the full Congress will pass this legislation remains unclear, but the bill may signal the industries that could be future targets of the Outbound Investment Program.

Look for Reactions from China

While the Executive Order is both long-anticipated and narrower than originally conceived, it has been “resolutely opposed” by China. On August 10, 2023, China’s Ministry of Commerce (MOFCOM) characterized the Executive Order as “decoupling and chainbreaking” in the area of investment under the guise of “de-risking.” MOFCOM’s spokesperson chided the U.S. for deviating “from the market economy and principle of fair competition that the U.S. has been advocating” and that China reserves the right to take countermeasures.

In light of the Executive Order’s singular focus on China as a “country of concern” and the ongoing geopolitical tensions between the U.S. and China, it is possible China may respond with heightened scrutiny on U.S. investors or companies in China (e.g., including through its Anti-Foreign Sanctions Law or AFSL) or new restrictions. U.S. companies and investors assessing the risks of prospective investments in China should take into account not only the imminent U.S. restrictions, but also the potential for a possible Chinese reaction.

In addition to possible Chinese government action, aggrieved Chinese parties involved in current or prospective U.S. investment could sue those investors under the AFSL if such U.S. investment is terminated or withdrawn.

Look for Actions and Reactions from Other Governments

Although outbound investment review regimes have historically been limited to only a few economies (e.g., Republic of Korea, Japan, China, and Chinese Taipei) and differ among these, there is active consideration outside the U.S. of potential restrictions on outbound investments in strategic technology with military capabilities. The European Commission is examining the issue in 2023 and European Commission president Ursula von der Leyen has spoken in favor of the establishment of a targeted outbound investment regime.

Passage of CFIUS reform in 2018 led the U.S. to work with its allies to strengthen their investment review regimes to better address national security concerns. Investors will want to consider whether this Executive Order may lead to similar consideration of targeted outbound investment reviews in the European Union and elsewhere.

Contacts

Insights

Client Alert | 3 min read | 02.27.26

On February 17, 2026, the U.S. Equal Employment Opportunity Commission (EEOC) filed a complaint against Coca-Cola Beverages Northeast, Inc., in the United States District Court for the District of New Hampshire, alleging that the company violated Title VII of the Civil Rights Act of 1964 (Title VII) by conducting an event limited to female employees. The EEOC’s lawsuit is one of several recent actions from the EEOC in furtherance of its efforts to end what it refers to as “unlawful DEI-motivated race and sex discrimination.” See EEOC and Justice Department Warn Against Unlawful DEI-Related Discrimination | U.S. Equal Employment Opportunity Commission.

Client Alert | 6 min read | 02.27.26

Client Alert | 4 min read | 02.27.26

New Jersey Expands FLA Protections Effective July 2026: What Employers Need to Know

Client Alert | 3 min read | 02.26.26