EU Adopts the Largest Ever Trade Countermeasures Against the U.S. to Apply if EU-U.S. Trade Negotiations Fail

What You Need to Know

Key takeaway #1

The Commission announced European Union (EU) countermeasures as a single package to all types of U.S. tariffs on EU products. These measures include additional customs duties (ranging from 4-30%) on U.S. products as well as export restrictions for certain EU products shipped to the U.S.

Key takeaway #2

EU countermeasures will start applying from August 7 if the ongoing EU-U.S. trade negotiations fail and the US proceeds with the threatened higher The International Emergency Economic Powers Act (IEEPA) tariffs.

Key takeaway #3

EU Member States are now seriously considering using the Anti-Coercion Instrument (ACI) against the U.S. if the EU-U.S. trade negotiations fail. The instrument has been referred to as the “Trade Bazooka”.

Client Alert | 15 min read | 07.25.25

On July 24, the European Commission announced the imposition of new EU countermeasures in response to U.S. tariffs further to an agreement reached among EU Member States. These measures are adopted through Commission Implementing Regulation (EU) 2025/1564 and take the form of additional customs duties on U.S. products as well as export restrictions for certain EU products. In total, these measures concern about EUR 93 billion ($109 billion) worth of customs duties, the highest volume of bilateral trade caught by the EU so far. The EU countermeasures are set to enter into force as of August 7.

Why new EU countermeasures?

In April 2024, the Commission had only imposed countermeasures on U.S. products in response to U.S. Section 232 tariffs on steel and aluminum. These countermeasures were, however, immediately suspended to allow room for trade negotiations between the EU and the U.S.

After the imposition of sweeping IEEPA tariffs, the EU held further consultations on countermeasures targeting additional U.S. products. U.S. President Donald Trump’s announcement that his administration will impose 30% tariffs on EU products hastened the EU’s decision to impose further countermeasures.

What are the new EU countermeasures?

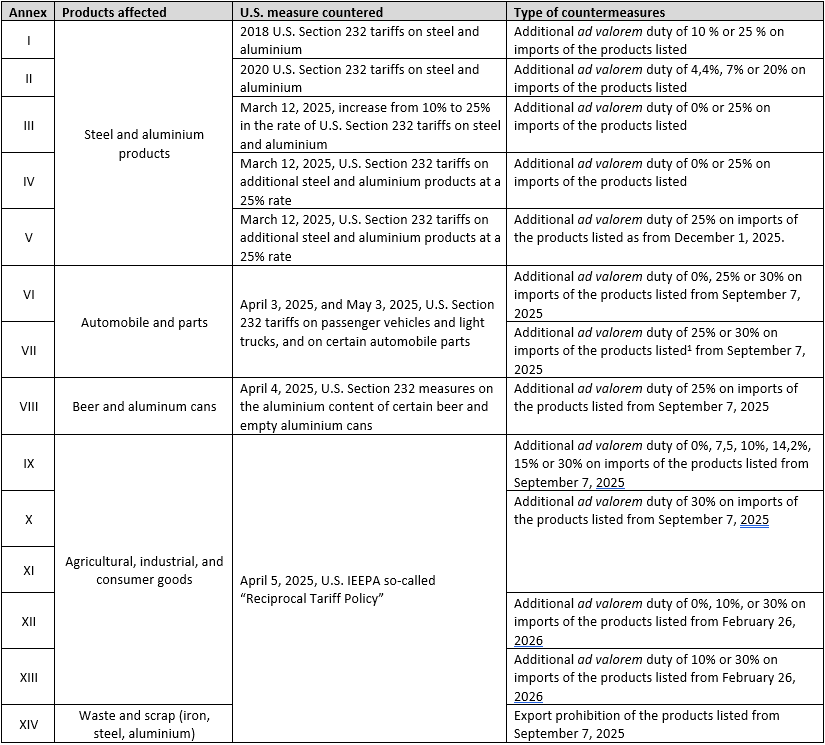

This new package of EU countermeasures replaces the previously existing (and suspended) countermeasures. It is intended to strictly abide by international legal standards by invoking the violation by the U.S. of the WTO Agreement on Safeguards, as extensively explained in the countermeasures’ preamble. The detailed measures imposed by the EU are found in the annexes to the Regulation. There are a total of 14 annexes:

- 13 annexes list U.S. products, identified by customs codes, on which the EU imposes additional customs duties ranging from 0% to 30%.

- A 14th annex lists EU products (CN Codes 7204, 7206 – products containing metal scraps) which the EU imposes an export prohibition to the U.S. (annex XIV). This export prohibition does not apply in cases of humanitarian use, health emergencies, and environmental disasters.

- A suspension for Defense-Related Imports was incorporated to protect EU security interests. Duties will be suspended for:

- U.S. military equipment under Regulation (EU) 150/2003

- Select products in Annexes VII, X, and XIII

The EU’s most extensive countermeasures to date are summarized in the below table:

Will the EU countermeasures apply?

These countermeasures will apply should EU and the U.S. fail to find a trade agreement by August 1. For this reason, the entry into force of the EU countermeasures is delayed to August 7. The EU countermeasures currently aim to balance the EU’s leverage in the ongoing EU-U.S. trade negotiations. Should these negotiations fail, there seems to be a robust political will among EU Member States and the Commission to impose them.

The EU countermeasures are a “package” against the combined U.S. Section 232 and IEEPA tariffs. It is unclear at this time what the EU countermeasures will look like if the U.S. backtracks on IEEPA tariffs but maintains the multiple Section 232 tariffs, which, the Commission characterizes once again in this Regulation as safeguard measures, and departing from the United States’ obligations flowing from WTO Agreement on Safeguards. We understand that the current political will of the EU seems to be a “tit-for-tat” approach to countermeasures, therefore these are likely to be commensurate with the loss of trade benefits the EU will suffer under the WTO legal order.

Media outlets report that Member States are now more seriously considering activating the EU’s Anti-Coercion Instrument (“ACI”) in retaliation to any U.S. measures if negotiations fail. Additionally, France and Germany have agreed on the need to have further leverage in these negotiations and to respond in a robust way should U.S. economic coercion upon the EU persist. For more details about the ACI, you may consult our article on this new and thus far unused EU trade defence instrument.

[1] At the time of writing, there appears to be an inconsistency between the articles of the Regulation and its annexes. Article 2(f) refers to an additional ad valorem duty of 25% or 30% for Annex VI, whereas Annex VI also provides for rates of 0%. Conversely, Article 2(g) refer to an additional ad valorem duty of 0%, 25% or 30% for Annex VII, whereas Annex VII does not provide for any rate of 0%.

Contacts

Insights

Client Alert | 3 min read | 02.27.26

On February 17, 2026, the U.S. Equal Employment Opportunity Commission (EEOC) filed a complaint against Coca-Cola Beverages Northeast, Inc., in the United States District Court for the District of New Hampshire, alleging that the company violated Title VII of the Civil Rights Act of 1964 (Title VII) by conducting an event limited to female employees. The EEOC’s lawsuit is one of several recent actions from the EEOC in furtherance of its efforts to end what it refers to as “unlawful DEI-motivated race and sex discrimination.” See EEOC and Justice Department Warn Against Unlawful DEI-Related Discrimination | U.S. Equal Employment Opportunity Commission.

Client Alert | 6 min read | 02.27.26

Client Alert | 4 min read | 02.27.26

New Jersey Expands FLA Protections Effective July 2026: What Employers Need to Know

Client Alert | 3 min read | 02.26.26