Significant Changes Are in the Works for EU Environmental, Social, and Governance (ESG) Laws

What You Need to Know

Key takeaway #1

Over the past few weeks, European institutions have indicated that companies should expect significant changes simplifying a wide range of environmental, social, and governance (ESG) laws in the European Union.

Key takeaway #2

There will likely be significant streamlining of both the substantive requirements and the number of companies subject to key EU ESG laws. These include the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CS3D), the Carbon Border Adjustment Mechanism (CBAM), the Deforestation Regulation (EUDR) and the EU Climate Law.

Key takeaway #3

Some EU environmental texts still under negotiation, like the Green Claims Directive (GCD) and the Forest Monitoring Law, might be scrapped entirely if no agreement is reached on important changes.

Client Alert | 18 min read | 07.31.25

Following the February announcement of the Omnibus package, the European Commission, Council, and Parliament have made several decisions indicating ways in which EU ESG laws are likely to be streamlined. This alert provides a high-level summary of the most significant proposed changes to existing and draft ESG legislation.

You can expect continued turmoil in this area as European institutions and individual countries negotiate ragarding the substantive ESG requirements, which companies will be subject to them, and when they will take effect. We will continue to track these developments, including those in other important jurisdictions like California, and advise companies on how best to prepare for potential domestic and multinational ESG compliance obligations.

Ongoing Modifications of Existing Legislation

Corporate Sustainability Reporting Directive (CSRD)

The CSRD is an EU Directive requiring comprehensive sustainability reporting by a wide range of companies. The Commission proposed reducing the number of companies required to issue reports and significantly scaling back the number of data points that will be required to be reported.

Recent proposed modifications include:

- The European Financial Reporting Advisory Group (EFRAG) – which is tasked to draft the CSRD’s sustainability reporting standards (ESRS) – plans to reduce the number of data points under the ESRS by more than 50%.

- The double materiality assessment will no longer be a checklist of standards to meet. Instead, reporting companies should focus on the most obvious material topics based on their business model analysis.

- ESRS will be aligned with international reporting standards like the International Sustainability Standards Board’s (ISSB) International Financial Reporting Standards (IFRS) S1 and S2 standards which are used globally. The aim is to reduce burden and avoid duplication. This alignment would enhance cross-jurisdiction interoperability, so that companies that already carry out sustainability reporting in third countries can use this reporting work to meet reporting requirements in the EU.

- The Council proposes to scale back the number of companies the directive would apply to by increasing the applicability threshold to 1,000 employees and €450 million in net turnover.

On July 11, the Commission adopted “quick fixes” to the CSRD by way of a delegated Regulation. The action is intended to delay the application of reporting obligations for the first companies required to report (“Wave 1 companies”) as they were not covered by the “stop-the-clock” Directive which delayed reporting requirements for many companies A summary of the modifications is available here. Main changes include:

- Wave 1 companies will not have to report additional sustainability information in financial years 2025 and 2026 beyond what is required for 2024.

- Allowing all Wave 1 companies, including those with more than 750 employees, to benefit from the existing phase-in provisions that delay certain sustainability reporting obligations by 2 years for companies with fewer than 750 employees.

Corporate Sustainability Due Diligence Directive (CS3D)

The CS3D is an EU Directive requiring companies to carry out and report on due diligence of their supply chains to identify and address risks of human rights and environmental violations arising out of the company’s entire value chains.

Because of the important body of work required to meet the requirements of the CS3D, and the intensification of the litigation based on sustainability due diligence non-compliance (to that end, please refer to our article discussing early lessons from France’s national legislation in that matter), the Commission has proposed to considerably limit the scope of application as well as the content of the sustainability due diligence to be performed.

The Council proposes:

- Reducing the number of companies impacted by CS3D by raising the applicability threshold to 5,000 employees and €1.5 billion in net turnover;

- Limiting due diligence requirements to direct “Tier 1” business partners (rather than conducting efforts deeper into the supply chain), still using a risk-based approach;

- Delaying the transposition deadline by one year to 26 July 2028;

- Removing the harmonized civil liability provision;

- Involving the Member States’ supervising authority to advise companies in the adoption, design and implementation of the transition plan.

Carbon Border Adjustment Mechanism (CBAM)

Under CBAM, emissions on goods in certain energy-intensive sectors must be reported when imported into the EU’s customs territory. CBAM is conceived as the corollary of and set to replace the EU’s internal Emissions Trading System to prevent carbon leakage.

Last month, the Parliament and Council agreed to dramatically reduce the number of companies impacted by CBAM by broadening the de minimis exemption to exclude 90% of the importers. For more info on the ongoing omnibus CBAM simplification, please refer to our previous client alert on the topic.

Deforestation Regulation (EUDR)

The EUDR is an EU Regulation requiring traders and operators of certain commodities frequently associated with deforestation to ensure that their products do not contribute to deforestation.

The applicability of the EUDR has already been delayed by a year to the end of 2025 to give stakeholders additional time to prepare to the EUDR and consider Commission’s guidance. Given the Commission’s recent ESG simplification efforts, conservative members of the European Parliament (MEPs) are pushing for a simplification of the EUDR due diligence simplifications as well.

Recent developments include:

- The Commission published country benchmarking, classifying all Member States as “low risk.”

- The European Parliament’s ENVI Committee voted to object to the Commission’s benchmarking, pushing for a “zero-risk” category.

EU Climate Law

The EU Climate Law is the legislation by which the EU sets its climate objectives. On July 2, the Commission proposed amendments, including:

- Setting a 2040 EU climate target of 90% reduction in net GHG emissions compared to 1990 levels.

- Creating flexible ways to meet the 2040 target, including using high-quality international credits from 2036, and domestic permanent removals in the EU Emissions Trading System.

Legislation Under Threat of Withdrawal

Green Claims Directive (GCD)

The GCD is an EU Directive, still in draft form, that is intended to strengthen requirements for how companies make and substantiate green claims (sustainability claims regarding a company or its products).

However, in the course of the negotiations, the Commission announced its intention to withdraw the text if microenterprises were not exempted from the scope of the anti-greenwashing proposal. Several Member States, including Italy and Latvia support the Commission’s decision.

Forest Monitoring Law

The Forest Monitoring Law is a draft EU Regulation that would set up a monitoring framework designed to obtain more precise, complete and up-to-date information on European forests.

The Commission threatened to withdraw the text due to the Council’s push to simplify it.

Next Steps

The European Parliament must reach its negotiating position on the first Omnibus package. The content is uncertain due to fluctuating political majorities and 874 amendments to review. Once this is done, the trilogue negotiations are expected to begin by the end of the year. The Commission’s recent stance in trilogue regarding the Green Claims Directive and the Forest Monitoring Law suggests conflicting positions between EU co-legislators on the degree of simplification to achieve.

Broader EU Law Changes

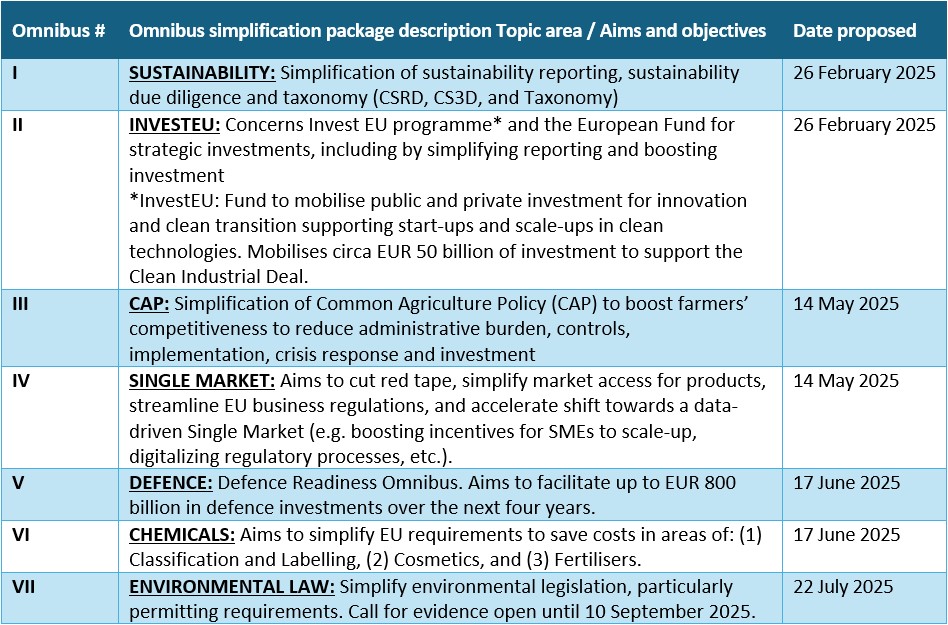

The changes to sustainability and ESG laws discussed in this alert are just part of a broader suite of modifications to EU Laws that are being considered.

For example, as part of the “first simplification omnibus”, the EU will soon adopt revised Do No Significant Harm (DNSH) criteria for pollution prevention and control under the Taxonomy for sustainable investments. By limiting the scope in terms of substances covered, this action will significantly reduce the burden to demonstrate alignment with the Taxonomy and facilitate easier access to sustainable finance.

Crowell & Moring is continuing to track these developments, which are likely to include changes to chemicals, environmental and other important EU laws, as noted in the following chart.

Contacts

Insights

Client Alert | 15 min read | 03.06.26

The Month in International Trade – February 2026

Chambers Ranks Crowell & Moring International Trade Practice and Lawyers in 2026 Global Guide

Client Alert | 6 min read | 03.06.26

Tri-Agencies Release Fourth Mental Health Parity Report to Congress

Client Alert | 4 min read | 03.05.26

Client Alert | 8 min read | 03.05.26