Trade — Building Bridges — In Two Directions

Publication | 01.19.16

Obama administration officials are working to cement the president’s legacy during his final year in office by pushing through two of the largest trade agreements in history—one that could open previously untapped Asia-Pacific markets, and one that would make it easier for U.S. companies to do business in Europe.

PIVOTING TOWARD ASIA

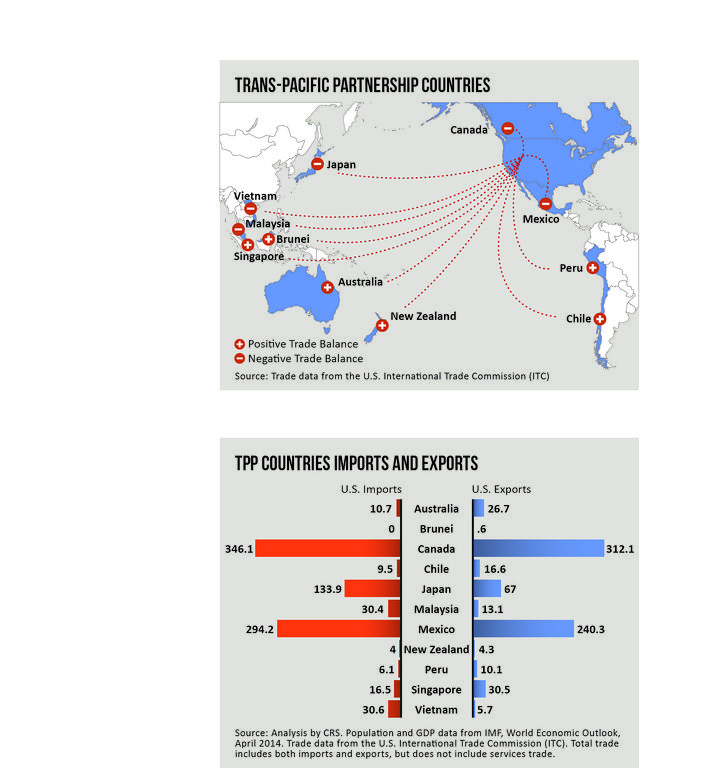

Sealing the 12-country Trans-Pacific Partnership (TPP) Agreement would be the capstone of the administration’s pivot-toward-Asia policy, which calls for increased engagement in the region. Negotiations, which began during the George W. Bush administration, were concluded on Oct. 5, but the deal still faces an uphill battle in Congress, where it must be signed and ratified.

As a group, the TPP countries—including Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam—represent the United States’ third-largest goods export market and its fourth-largest services export market. “Japan, Malaysia, and Vietnam in particular have had high barriers to trade in the past and could present great new opportunities for U.S. companies once the TPP is adopted,” says James Smith, the former U.S. ambassador to the Kingdom of Saudi Arabia and current president of C&M International, an affiliate of Crowell & Moring.

Japan’s agricultural, chemical, and insurance sectors could become more viable markets in which U.S. companies could compete, Smith notes. The deal would also create a more level playing field for U.S. companies vying for government contracts in the Asia-Pacific region. In addition, opportunities for logistics and delivery companies could open up in many TPP countries where foreign firms were once effectively blocked.

The deal, says Paul Davies, director at C&M International, could enhance legal protections for U.S. companies doing business in TPP markets by strengthening enforcement on patents, trademarks, and copyrights as well as requiring non-discriminatory treatment under local laws.

SHORING UP EUROPEAN TIES

Although the current migrant crisis is expected to demand European Union (EU) officials’ attention in the near term, the EU and the Obama administration have set an ambitious goal of having the Transatlantic Trade and Investment Partnership (TTIP) negotiated by the end of 2016. With the U.S. and EU accounting for nearly half of global economic output, the TTIP would be the largest trade agreement ever.

Although U.S. trade with Europe is already significantly more open than with many of the TPP countries, the TTIP would eliminate customs duties on goods and services between the U.S. and the EU—a $2.7 billion-a-day trading corridor, according to the Office of the U.S. Trade Representative. It also aims to reduce the high cost of complying with duplicative U.S. and European regulations. For example, U.S. automakers that have already run crash tests to meet U.S. standards may not have to repeat the test in order comply with EU regulations. The deal would also open government contract bidding in the EU to U.S. firms, and vice-versa.

According to the London-based Centre for Economic Policy Research, the TTIP would add $125 billion to the U.S. GDP each year by boosting U.S. exports to the EU by $300 billion.

Developing ways of ensuring “regulatory coherence”—where each jurisdiction implements its own regulatory processes, but with increased input and cooperation from the other—has been a key sticking point among negotiators. Particularly in Europe, there’s a sentiment that more closely aligning EU regulation with that of the United States would represent “downward harmonization.”

“There is the view among some in Europe that their food is safer, their environment cleaner, and their products of a higher standard, and that that justifies burdensome and duplicative regulation,” says Davies. “But there’s not a great deal of evidence to support that.”

[Supporters believe the TPP could ease trade imbalances with some countries, such as Vietnam, Malaysia, and Japan, that have been relatively closed to U.S. exports.]

Despite Eased Restrictions, Caution is Required

The recent easing of trade restrictions against formerly ostracized countries such as Cuba and Burma (Myanmar) presents potential opportunity for U.S. businesses—but also significant risk. That’s because those jurisdictions remain fairly closed economies, run largely by government entities or former government officials. Although the sanctions specter may be diminishing, the risk exposure for corruption and money laundering remains, says Crowell & Moring partner Cari Stinebower, a former counsel for the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC).

The Foreign Corrupt Practices Act (FCPA) prohibits U.S. companies from paying an official of a foreign government to corruptly obtain a business benefit. In countries that have been isolated from modernized economies for decades, such payments may be considered acceptable business practices. “Until these countries have a chance to catch up to global standards, you really have to tread carefully,” says Stinebower.

The U.S. Department of Justice in particular signaled its ongoing concern about FCPA compliance in July 2015, when it confirmed it had hired an attorney to serve in a newly created position of FCPA compliance expert. The U.S. Securities and Exchange Commission, which also enforces the FCPA, created a specialized FCPA unit in 2010. Federal banking regulators and even local prosecutors in the Manhattan district attorney’s office have also been honing in on anti-corruption issues.

The evolution of the compliance function within a U.S. business continues, says Stinebower. The expectation is that an entity will have a culture of compliance, driven from the top, but evident throughout the enterprise.

“The role of the compliance division within an entity is to ensure the compliance program is designed to mitigate risk and is nimble enough to evolve and adapt to new scenarios,” she says. “The role of the compliance officer is to carry out the program—but also to know the business well enough so as to address evolving risks.”

[PDF Download: 2016

| |

[Web Index: 2016 Regulatory

|

Insights

Publication | 01.05.26

Publication | 01.02.26

Publication | 12.17.25

Publication | 12.15.25

International Comparative Legal Guide - Telecoms, Media & Internet 2026