Belgian Social Partners Reach Agreement on Four Key Social Topics

Client Alert | 34 min read | 06.16.21

On Tuesday June 8, 2021, the Belgian Group of Ten (i.e., the consultative body of trade unions and employers, the “social partners”) reached general agreement on four social topics. This agreement follows the government’s conciliation proposal to the social partners of May 2021, whereby the government instructed the social partners to find practical solutions with respect to the following four topics.

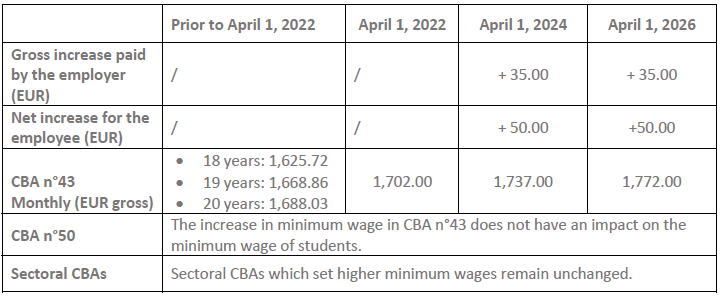

1. Increase in the minimum wage

The social partners decided to increase the minimum wage in four different steps:

- Step 1 will take place on April 1, 2022 and focus on the harmonization and the increase in the minimum wage. The cost of the increase for employers is to be compensated for as far as possible by a reduction in social security contributions. In addition, the social partners decided to abolish the age and seniority criteria attached to the calculation of the minimum wage. As a consequence, one minimum wage will apply to all (as of April 1, 2022): 1,702.00 EUR gross per month.

- Steps 2 and 3 are part of the fiscal reform and will take place on April 1, 2024 and April 1, 2026. The purpose is (i) to limit the additional costs for employers linked to the gross increase in the minimum wage and (ii) to ensure that the gross increases will effectively result in net increases for the employees.

- Step 4 will take place on April 1, 2028 and involve an evaluation in view of further increases (e.g., effect of the increase on sectoral minimum wages).

Summary:

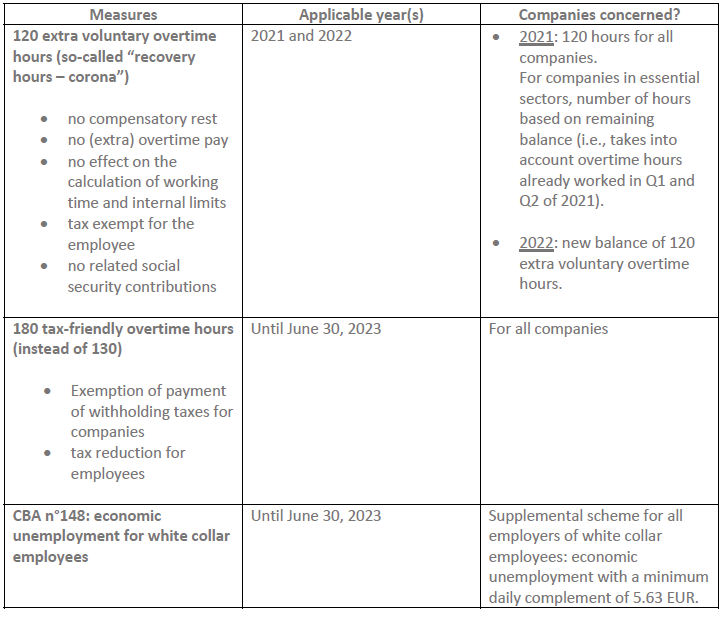

2. Flexibility measures

The social partners have agreed on the following flexibility measures:

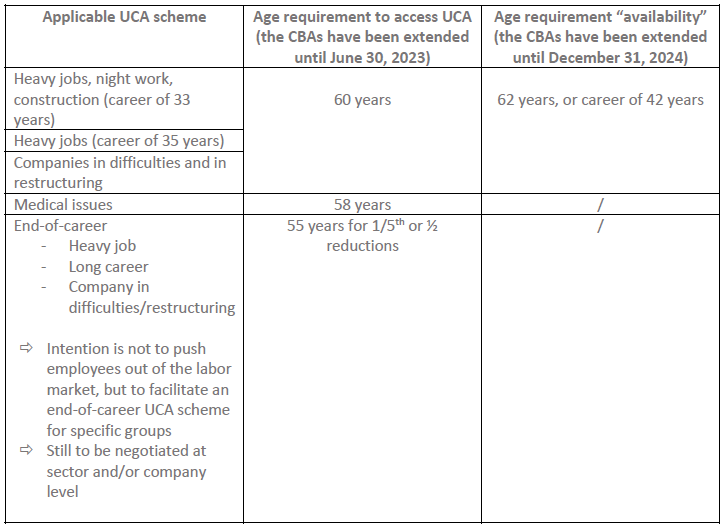

3. Unemployment with company allowance scheme (UCA)

The social partners decided on the following points with regard to unemployment with company allowance schemes:

4. Harmonization of supplementary pensions of blue and white collar employees

The social partners have decided:

- to postpone the deadline for the harmonization of the supplementary pensions of blue and white collar employees. The deadline is now January 1, 2030 (instead of January 1, 2025);

- to set a new deadline for the deposit of sectoral CBAs: January 1, 2027 (instead of January 1, 2023)

- for the years 2021-2022, to request that the joint committees make concrete efforts towards harmonizing the pension schemes;

- for the years 2023-2028, to devote part of the wage margin (at least 0.1%) to the harmonization;

- to maintain the status quo regarding the (para)fiscal rules (e.g., 8.86% of employer’s social security contributions); and

- to preserve the employee’s choice between a lump sum or an annuity.

5. Next steps?

The agreement reached between the social partners still has to be formally approved by the trade unions and by the board of directors of the Federation of Belgian Companies. This approval is expected to be given by the end of June 2021.

In addition, a royal decree from the federal government can be expected, in which the wage norm of 0.4% for the upcoming two years will be fixed.

Contacts

Insights

Client Alert | 3 min read | 03.12.26

DOJ Releases First-Ever Department-Wide Corporate Enforcement and Voluntary Self-Disclosure Policy

On March 10, 2026, the Department of Justice released the first-ever Department-wide Corporate Enforcement and Voluntary Self-Disclosure Policy (the “Department-wide CEP” or “Policy”), which applies to all non-antitrust corporate criminal cases across the Department. The new policy has been anticipated since December 2025, when Deputy Attorney General Todd Blanche announced the Department’s plans to release a new, single corporate enforcement policy for all criminal matters. According to the Department, the new policy is designed to “help ensure consistency across the Department” and “transparently describe the Department’s policies and decisionmaking.”

Client Alert | 3 min read | 03.12.26

Client Alert | 2 min read | 03.11.26