Advance Pricing Arrangement in China: An Effective Tax Planning Tool for Multinational Companies

Client Alert | 72 min read | 05.10.21

The China State Taxation Administration (“STA”) recently published its eleventh “China Advance Pricing Arrangement Annual Report (2019)” that summarized the circumstances under which the STA signed advance pricing arrangements (“APA”) and introduced the latest APA regulations and requirements for the implementation of the APA program in China. The report included data for the period from January 1, 2005 until December 31, 2019. In the United States, the Internal Revenue Service’s (“IRS”) Advance Pricing and Mutual Agreement program (“APMA”) issued its annual report on activities of the U.S. APA program during 2020. The two reports underline the importance of APAs as tax planning tools for multinational companies operating in China and the United States. The two tax authorities have been meeting regularly for years to discuss APA and competent authority cases, have developed a productive working relationship, and are handling an increasing number of cases.

What is an APA?

China’s report defines an APA as “an arrangement whereby an enterprise applies in advance to negotiate and reach agreement with the tax authorities in respect of the transfer pricing methods and corresponding calculation methods to be applied to its related party transactions for future years in accordance with the arm’s length principle.” An APA could apply to covered related party transactions for up to 3 to 5 tax years after the execution of the agreement, with the possibility of extension.

By way of example in a reported case, the Chinese subsidiary of a multinational company entered into an APA with the STA, after a couple years and more than 10 rounds of negotiations with the STA and the corresponding tax authority of the overseas related party. The APA confirmed the transfer pricing policies and the profit margin of the related party transaction for the next three years. Under the arrangement, the tax authority of the overseas related party would provide corresponding tax rebates on the adjusted tax amounts paid in China, thereby erasing the double taxation risk between the two countries for the company and reducing the overall potential tax burden for the company by over RMB 100 million (about USD 15,260,000). The company was thus able to mitigate its tax risks by obtaining certainty on the profit margin as confirmed under the APA, and plan its operations accordingly for the duration of the period the APA remains valid.

From a Chinese tax perspective, one advantage of the APA is to create an effective path forward between the multinational company and the tax authority to increase trust, enhance cooperation, and reduce confrontation. Another advantage is to take away the guess work for the near future on transfer pricing issues with the relevant government(s). A third advantage is to effectively avoid the risk of audits by the tax authority on transfer pricing issues, thereby reducing tax compliance costs for the enterprise. Additionally, a bilateral (with two countries) or multilateral (with more than two countries) APA can significantly reduce the company’s transfer pricing adjustment risks in two or more countries and effectively manage or erase any potential double taxation.

The U.S. APA program, which APMA administers, is a well-established procedural mechanism for resolving transfer pricing issues. The IRS has completed almost 2,000 APAs since the program began in 1991. Rev. Proc. 2015-41 provides procedures for filing of APA requests, consideration by APMA, administration of APAs by the taxpayer and APMA, and renewal of APAs. The 2020 APMA report includes model APAs as appendices. As with China’s STA, the U.S. APA program involves a prospective agreement between the taxpayer, the IRS, and in bilateral APAs, the treaty partner’s taxing authority, on the transfer pricing methodology that will be applied during the APA’s term to the inter-company transactions that are the subject of the APA. Although APAs must apply prospectively, they also can be an effective mechanism for resolving transfer pricing disputes that have arisen in audits of prior years – through rollbacks of transfer pricing methods agreed in the APA.

An Overview of the APAs signed by China

An APA can be unilateral (between just the company and the STA), bilateral (involving the STA and one other country) or multilateral (involving the STA and more than one other country). According to statistics provided by state and regional tax authorities in China, in the 15 years between 2005 through 2019, China signed a total of 177 APAs, of which 101 are unilateral, and 76 bilateral. There has not been any multilateral APA signed yet. In 2019, the latest year included in the report, the SAT signed 21 APAs, which is a record. Of these, 12 were unilateral APAs.

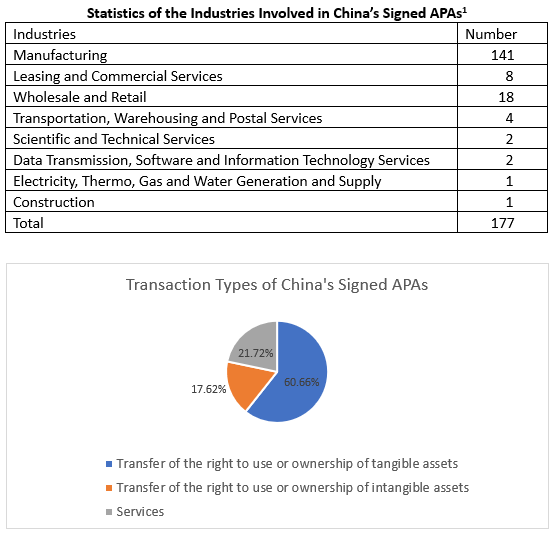

The chart below shows that the manufacturing industry entered into 141 APAs, representing the vast majority of the total executed APAs in China at 80%. With the development of the services industry, it is expected that APAs in non-manufacturing sectors will increase in the future.

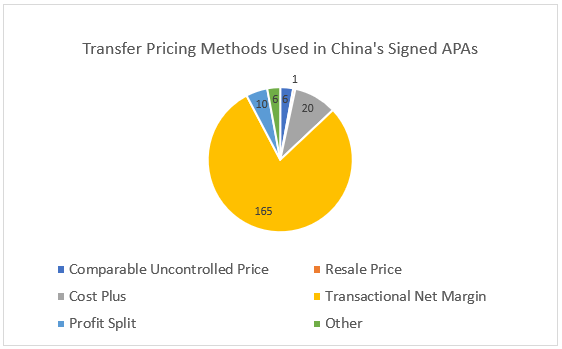

More than 60% of APAs signed in China are related party transactions primarily involving the transfer of the right to use or ownership of tangible assets. So far, there has not been any APA concluded in relation to financing or transfer of financial assets. As China further develops, APAs involving the transfer of the right to use or ownership of intangible assets, labor services transactions, financing and transfer of financial assets may increase. Indeed, the STA report states: “As China’s tertiary industry develops, an increasing number of service companies may decide to apply for APAs. Thus, more APAs may involve transactions related to transfer of the right to use or ownership of intangibles, services, financing and transfer of financial assets.”

The above chart shows that the transactional net margin method is the most common transfer pricing method in APAs signed in China, having been used 165 times, representing 80% of all cases. Within the 165 cases using the transactional net margin method, EBIT operating margin has been used 67 times, and full cost mark up 96 times. Following the transactional net margin method in frequency is the cost-plus method (20 cases), profit split method (10 cases), comparable uncontrolled price method (6 cases), other methods (6 cases) and the resale price method (1 case).

Application Procedure in China for Signing APAs

A multinational company operating in China should consider the use of APAs when its transfer pricing risk is relatively high in China, and the annual related party transaction amount exceeds RMB 40 million for the three tax years prior to the application.

Under the following circumstances, the tax authority may prioritize a company’s application for the APA:

- The related party reporting and contemporaneous transfer pricing documentation of the company are complete with sufficient disclosures.

- The company has a tax compliance rating of A.

- The tax authority had conducted and concluded its special tax adjustment investigation on the company.

- A signed APA is approaching its expiration date and the company is applying for a renewal with no substantial changes to the facts and circumstances as specified in the APA.

- In its application for the APA, the company has provided sufficient application materials, with complete and clear analysis of the value chain or supply chain that adequately considered specific regional issues such as cost savings and market premium as well as reasonable pricing principles and calculation methods.

- The company cooperates with the tax authority’s APA discussions.

- The corresponding tax authority under bilateral or multilateral APA discussions has expressed a strong intent to negotiate the APA or has attached a high importance on the APA.

The process toward the signing of the APA includes communication, negotiation and consultation between the multinational company and the tax authority in China, and includes the following six stages: pre-filing meeting, letter of intent, analysis and evaluation, formal application, negotiations, and implementation/monitoring.

The time needed to complete the application and negotiation of the APA is relatively long. According to the STA, the vast majority of unilateral APA applications in China are completed in two years. Bilateral APAs typically take longer, at least two years, given the need to consider tax treaties, agreements or arrangements, as well as to negotiate and engage in mutual agreement with the corresponding tax authority.

The text of the APA includes the following:

- the related party transaction involved in the APA and the applicable years;

- the chosen pricing principle and calculation methods under the APA and the comparable price or profit rate;

- assumptions and an obligation to notify any changes in such assumptions;

- an obligation to provide an annual compliance report;

- the binding authority of the APA;

- renewal of the APA; and

- obligation to keep documents and information confidential.

As demonstrated in the report, China has a relatively mature and robust mechanism for concluding an APA, and the APA has been an effective tool to mitigate and manage transfer pricing risks for multinational companies and their Chinese subsidiaries. Accordingly, companies operating in China should consider APAs in its tax strategy and planning.

An Overview of the APAs signed by the United States

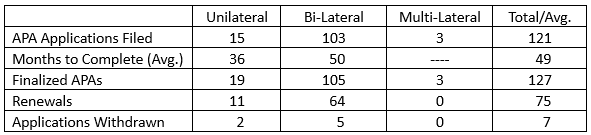

The APMA Annual Report includes statistics on the number of U.S. APA applications, time spent considering the applications, and number executed during 2020. The statistics highlight that obtaining an APA takes substantial planning, effort, time, and expense. Accordingly, tax departments should plan carefully their strategy for obtaining a finalized APA and explain to management that the process requires patience.

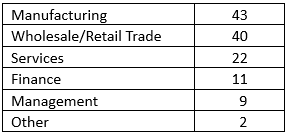

The APMA Annual Report also includes data on the industries involved, treaty partners on bi-lateral APAs, and transfer pricing methodologies adopted in the APAs executed in 2020. 61 percent of the APAs involved a foreign parent with a U.S. subsidiary; 27 percent involved a U.S. parent and non-U.S. subsidiary. The industries involved were as follows:

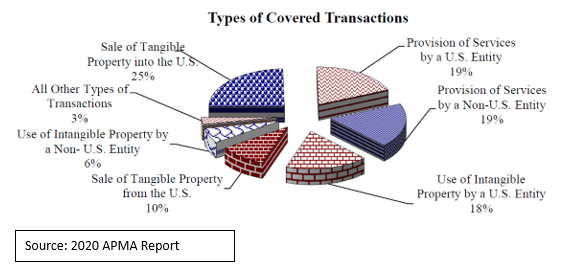

As compared to the China statistics, the APMA Annual Report shows a different mix of types of transaction that were subject to U.S. APAs. As noted above, the SAT’s 2019 Report reflects that 61 percent of SAT-approved APAs completed in 2019 involved transfers of tangible assets, 18 percent involved rights to intangible assets, and 22 percent involved services. The following chart from the APMA report shows that transfers of goods were less prominent, and transfers of intangible assets and services were more prominent:

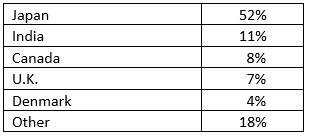

The 2020 U.S. APAs were divided among the following countries:

These statistics show that there are few U.S.-China APAs – presumably less than 4 percent of the APAs finalized in 2020. Consistent with prior years, the 2020 APMA report also shows that the most common transfer pricing method adopted in U.S. APAs was the comparable profits method/transactional net margin method (CPM/TNMM), which was used for 84 percent of transfers of tangible and intangible property. Very generally, the CPM/TNMM compares the profitability of the subject transaction to the profitability of comparable arm’s-length transactions using a profit level indicator for purposes of the comparison. The most common PLI was operating margin, which was used in 69 percent of APAs that applied the CPM/TNMM.

U.S.-China Competent Authority Negotiations

Representatives from the competent authorities of the United States (APMA) and China (STA) meet twice a year and work through interpreters. Typically, these have been week-long face-to-face meetings, with one week in the United States, and the other week in China. These face-to-face meetings reportedly are very productive, and both sides have worked hard to develop a warm working relationship so that they can work together to resolve APA and competent authority matters. The COVID-19 pandemic put face-to-face meetings on hold. However, the two sides recently held meetings by videoconference that, despite the challenges of communicating by phone over many time zones, were productive in terms of moving their docket of APA cases forward.

Currently, APMA and the STA have approximately 8-9 APA cases in process. Some U.S.-China APAs have been in place long enough that they are coming up for renewal. U.S.-China APA cases tend to involve U.S.-based multinationals with affiliates in China, although there have been APAs involving China-based companies investing in the United States. The docket involves a number of different industries with manufacturing or distribution in China, as well as intangible licensing arrangements. Taxpayers with intangibles in both countries have had good luck advancing APAs based on the residual profit split method (RPSM), because the competent authorities have a common understanding of how to apply the RPSM in these circumstances.

Final Thoughts

The U.S. and China enjoy a growing and productive competent authority relationship. As China’s economy continues to diversify, the APA process will become even more prominent as a means to resolve actual and potential transfer pricing disputes involving U.S.-china trade.

Contacts

Insights

Client Alert | 6 min read | 02.24.26

Artificial Intelligence and Human Resources in the EU: a 2026 Legal Overview

The year 2026 marks a major regulatory turning point for European companies using or considering the use of artificial intelligence in their human resources (HR) processes. The Regulation (EU) 2024/1689 on artificial intelligence (the AI Act) is entering a critical implementation phase, while the European Commission's "Digital Omnibus" package will clarify several obligations and modify certain deadlines.

Client Alert | 2 min read | 02.23.26

NYC’s Mayor Mamdani Joins the Wave of Local Consumer Protection Enforcement

Client Alert | 1 min read | 02.23.26

SCOTUS Tariff Decision: Implications for Retail and E-Commerce

Client Alert | 5 min read | 02.23.26

UK Government Seeks Evidence on Ownership and Control in Financial Sanctions Regulations