White Collar - This Time, It's Personal

Publication | 01.19.16

Last September, a memo by Deputy Attorney General Sally Yates sent shock waves through executive suites around the country.

The memo stated that companies facing prosecution that want credit for cooperation must turn over evidence of wrongdoing by specific individuals. Previously, companies could get credit for disclosing improper practices without identifying individuals. The new policy makes clear that providing complete information about individuals' involvement in wrongdoing is a threshold that must be crossed before the government will consider any cooperation credit.

Seven years after the financial crisis, the Obama administration appears to be reacting to criticism that it had coddled Wall Street executives by largely declining to prosecute senior bank officials, even as it imposed billions in fines for misconduct. Whether the new guidelines will result in a parade of executives heading to prison remains to be seen. What's more certain is that the guidelines will raise the stakes in investigations and settlement talks and present new dilemmas for companies.

The memo also stated that prosecutors should focus on individuals from the outset of the investigation and that, in most cases, prosecutors will not shield individuals from criminal exposure when resolving a matter with a corporation. Companies that receive credit for cooperation can save billions in fines and potentially avoid the criminal charges that can spur corporate collapse. But "with the bar for cooperation set so high, some companies will inevitably decide not to cooperate at all and litigate the case in court rather than spend so much time and effort in an internal investigation that could ultimately send their executives to jail," says Daniel Zelenko, a partner in Crowell & Moring's White Collar & Regulatory Enforcement Group and a former federal prosecutor with the Antitrust Division of the U.S. Department of Justice (DOJ) and former branch chief at the Securities and Exchange Commission's (SEC) Enforcement Division.

MAKING A CASE

Prosecutors will still find it challenging to send executives to prison, Zelenko says. They must prove the knowledge of and intent to carry out a criminal act, and it's unclear whether the DOJ will dedicate the extra manpower needed to make these cases. It's also unclear how far the DOJ will go to pursue executives who are foreign citizens or who are based in other countries—cases that bring their own complications.

Nonetheless, "general counsel facing an investigation must grapple with a new dilemma," Zelenko says. "How much do you want to protect your company against fines and criminal charges, and how much do you want to demonstrate that your company is a place where employees' rights are protected? Companies that appear too eager to turn over evidence against their own employees risk challenges in attracting and retaining employees."

One way a company could signal respect for its employees' rights is through a Directors & Officers insurance policy, which covers attorneys' fees for cases involving civil or criminal conduct occurring within the scope of employment. While most large companies have such policies, they may wish to bolster them through increasing coverage limits or expanding coverage to former employees, Zelenko says.

Another way to signal respect for employees' rights is through internal policy: companies that discipline employees who refuse to talk with regulators may want to rethink that approach. In any case, companies will still face a tough choice. They could encourage employees to retain experienced counsel at the beginning of the internal investigation. But those employees may be advised not to cooperate in an internal investigation, which would help the company receive cooperation credit from prosecutors. "In 2016, counsel can expect a lot more tension around the negotiating table," Zelenko concludes.

Other Issues to Watch

Electronic Search and Seizure

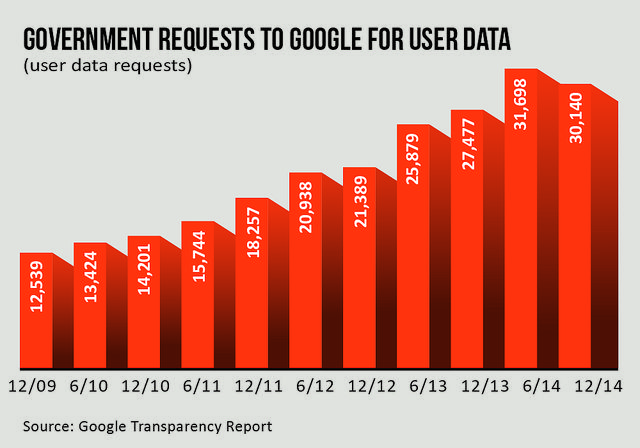

This may be the year the Supreme Court takes up the "third-party doctrine," which says there is no reasonable expectation of privacy in information voluntarily conveyed to a third party. In 2012, Justice Sonia Sotomayor joined many legal experts when she suggested that the doctrine should be reconsidered given the reams of personal data citizens now routinely convey through digital devices. If the Court overturns the doctrine, then the government may need a search warrant—and not just a subpoena—to demand personal information that companies store on behalf of their customers.

Insider Trading

A 2014 ruling by the Second Circuit, United States v. Newman, upended more than 30 years of legal precedent by establishing that the government must show that a tipper has received a benefit "of some consequence"—not just a casual friendship, for example—in return for the tip. The ruling significantly narrows the definition of insider trading on which courts and prosecutors rely. Last October, the Supreme Court denied the DOJ's petition to review the ruling.

SEC Forum Selection

It's clear why the SEC prefers to handle cases through its in-house administrative law judge: an analysis by The Wall Street Journal found that these judges were more likely to rule against defendants than were federal district judges. But by mid-2015, two federal judges in separate cases found that the SEC had not appointed its judges in a constitutional manner. As more defendants cite these rulings, "it will be a complicating factor for the SEC," and it may ultimately force changes in how the judges are appointed, Crowell & Moring's Daniel Zelenko says.

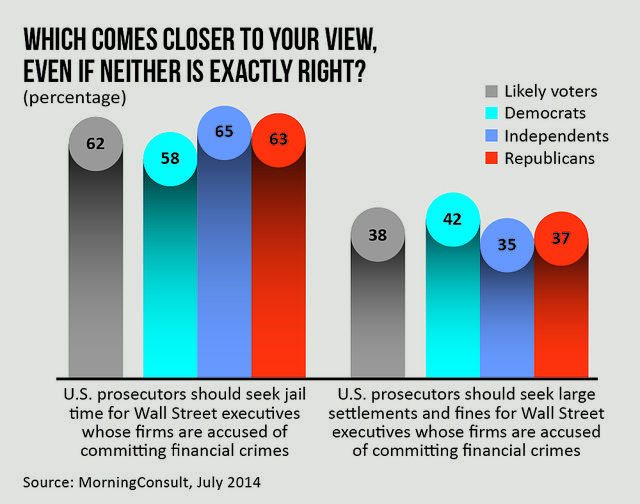

[Public sentiment may be contributing to a new emphasis on criminal convictions over fines by the Department of Justice, according to an online poll or registered voters conducted by MorningConsult, a Washington, DC-based technology and media company.]

[Growing government requests from companies for personal data has sparked concerns that the "third-party doctrine" is enabling privacy invasion.]

[PDF Download: 2016

|

|

[Web Index: 2016 Litigation

|

Contacts

Insights

Publication | May 25-27, 2008

“ISI mitigation using bit-edge equalization in high-speed backplane data transmission,” in IEEE International Conference on Communications, Circuits and Systems (ICCCAS 2008), pp. 589 - 593.

Publication | 04.18.24

Publication | 04.16.24

Rochester, NY, Diocese's Creditors To Mull Rival Ch. 11 Plans