Tax — Zombie Notices, 'Cadillac Tax' & Other Bugaboos

Publication | 01.19.16

Tax attorneys call them "zombie notices." As issued by the Internal Revenue Service (IRS), they manage to combine the only two certain things in life: death and taxes. And they strike horror—or at least anxiety—into the hearts of companies everywhere.

Jennifer Ray.

With a zombie notice, the IRS warns a taxpayer to cease a behavior because it violates a regulation that is forthcoming. "Then years go by, and the rules are never formalized through a rulemaking process. Yet the notice refuses to die," says Jennifer Ray, a partner in Crowell & Moring's Tax Group. "A rule stated in a notice doesn't have the same legal authority as a full regulation: it hasn't gone through Administrative Procedure Act-required public notice-and-comment periods. So the taxpayer is left wondering if these rules really apply and, if so, when they take effect."

Zombie notices have their roots in budget cuts at the IRS, which hampered the agency's ability to push through rules. "In the past, the IRS would issue temporary regulations but would not get around to finalizing them, leaving businesses in limbo," Ray says. "Congress stepped in and put a three-year time limit on temporary regulations. That's when the IRS began sending out more zombie notices."

But the zombies may have met their match. On July 27, 2015, the Tax Court handed down Altera Corp. v. Comm'r, which held that the Treasury Department is required to engage in reasoned decision making as interpreted in existing case law. Now, taxpayers can assert that the IRS must demonstrate reasoned decision making by, among other things, considering comments from the public, before handing down a rule that purports to have the force of law.

"I think there are additional opportunities to think about whether rules announced in notices can be challenged, where the IRS has not acted to issue a formal regulation," says Ray. "You can ask, 'How does this apply?' or 'How is this rule that the IRS is trying to apply in our case even valid?'"

RETIREMENT PLAN QUALIFICATIONS

Also this year, companies that sponsor tax-qualified retirement plans governed by the Employee Retirement Income Security Act of 1974 (ERISA) face changes in the IRS rules governing their plans. "The IRS eliminated in 2015 its program by which plan sponsors could periodically request a 'determination letter,' which verifies the tax-qualified nature of their plans," says Joel Wood, counsel in Crowell & Moring's ERISA & Employment Benefits Practice. "Plans may now request a determination letter only when first formed or when they are terminating. This will increase audit risks for plans and plan sponsors because tax-qualification issues may not be identified until audit. It will also complicate mergers and acquisitions, in which companies often rely on determination letters to show that retirement plans of acquired companies are tax-qualified. They'll need that verification before they will allow rollover of retirement accounts into their plans, among other reasons.

"This year, businesses involved in M&A will be pressed to show that they've made a detailed inquiry to justify saying, 'Yes, our plan is tax-qualified,'" adds Wood. "But even that is unlikely to win the day, because acquirers are still likely going to want indemnities built into the agreement." Since plans and companies can no longer rely on periodic opinions from the IRS, prudent businesses will work harder—and earlier—to ensure that their retirement plans are correct and up to date.

THE CADILLAC COMETH

Upcoming changes in another employee benefit—health care—will also be in the spotlight in 2016. The Affordable Care Act (ACA)'s excise tax on high-value health plans—known as the "Cadillac tax"—is now scheduled to take effect in 2020. But rulemaking is expected to begin this year. "The IRS has promised an extensive process of rulemaking, and we can expect to see it unfold rapidly this year to provide employers with sufficient lead time to prepare systems for the calculation, assessment, and payment of the tax," says Wood.

Ambiguity in the ACA has left employers wondering what health coverage will be subject to the tax. The answer: more than they might have thought. "Initial guidance suggests the IRS will take an expansive, aggressive view of the health care covered, resulting in far more group health plans being taxable than initially anticipated after the ACA was passed," Wood says.

The IRS will likely require a review of the value of each plan and how each person is individually covered, Wood says. But it's still unclear how employers will calculate the cost of the plans and what will happen if, for example, a business calculates the cost and the health insurance company disagrees with it. It's also unclear exactly how the tax will apply to self-funded plans.

[Mergers within health care are on the rise as organizations react to demand-for-care models based on patient outcomes. But IRS guidance for the effect these mergers will have on tax-exempt status is minimal at best.]

Health Care M&A: Staying Tax-Exempt

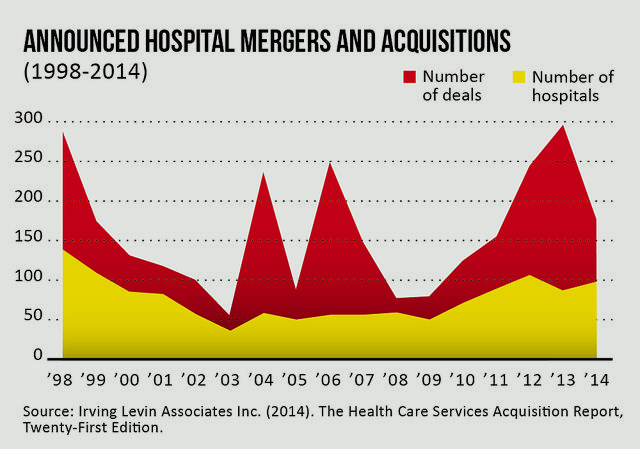

Reimbursement in the health care system is increasingly based on patient outcomes rather than service provision. To accommodate this transformation, many tax-exempt hospital systems have been merging with, acquiring, or working closely with taxable companies to establish new care models such as accountable care organizations and integrated delivery networks. But tax-exempt entities have received little guidance from the IRS on the extent to which they can participate in these ventures without risking their tax status.

"It appears that accountable care organizations under the Medicare Shared Savings Program are tax-exempt, but beyond that, the picture is murky," says Jennifer Ray. "This is on the cutting edge of health care tax law, and it's where a lot of people would like to see more guidance. The demand will only increase as more deals are considered."

[PDF Download: 2016

|

|

[Web Index: 2016 Regulatory

|

Insights

Publication | May 25-27, 2008

“ISI mitigation using bit-edge equalization in high-speed backplane data transmission,” in IEEE International Conference on Communications, Circuits and Systems (ICCCAS 2008), pp. 589 - 593.

Publication | 04.18.24

Publication | 04.16.24

Rochester, NY, Diocese's Creditors To Mull Rival Ch. 11 Plans