Antitrust — Healthcare Industry in the Spotlight

Publication | 01.19.16

Over the past five years, the American health care industry has faced unprecedented pressure to reduce cost and increase efficiency while enhancing quality and expanding patient access and choice.

That reality, and the incentives the country’s new regulations have created, has increasingly placed the health care industry in the antitrust spotlight.

The Affordable Care Act (ACA) is the primary driver of the ongoing restructuring of the health care industry. The regulatory mandates and financial incentives associated with the ACA have intensified the focus on reduced costs and improved coordination and quality of care. That has spurred new alliances and combinations across the industry, some of which are drawing the attention of antitrust regulators, from the Federal Trade Commission (FTC) and the Department of Justice (DOJ) to state attorneys general.

The agencies are reviewing these transactions closely and have recently challenged a series of proposed hospital tie-ups. As Assistant Attorney General Bill Baer recently noted, “While the ACA promotes collaboration and integration, it does not and was not meant to give anyone a free pass from the antitrust laws.”

But health care mergers are different from mergers involving, say, chemical or software companies. “The delivery of health care is typically a local business—people don’t usually travel far to get care,” says Mary Anne Mason, a partner in Crowell & Moring’s Antitrust Group. “So the merger review process often focuses not on the overall size of the merging parties but on whether those companies, regardless of their size, compete in a particular geographic area and with a particular product.” In addition, the ACA has brought many new competitors to the field—including accountable care organizations and other new entrants—and spurred the creation of insurance exchanges, both of which have increased competition in many local markets, further complicating the analysis.

The ACA has also triggered an increase in deals involving vertical integration—for example, combining hospitals and physician groups. Here, regulators are trying to reconcile the evolving approaches that are emerging in health care with the traditional theories of antitrust liability, says Mason. “There is a tendency in antitrust law to recognize that vertical integration is good because it usually leads to greater efficiency.” In the health care context, courts have viewed it as a more subtle issue. “The question becomes how the combination will result in the provision of better health care and how it will impact consumers and other hospitals,” says Mason. “That kind of issue becomes specific to the local area and requires a nuanced analysis.”

NEW SCRUTINY FOR NON-REPORTABLE DEALS

As part of their reaction to the changing health care arena, regulators are also looking closely at transactions that are not subject to Hart–Scott–Rodino (HSR) notification. The HSR Act requires pre-merger notification of mergers that exceed a certain value—currently, $76.3 million—to the DOJ and FTC, and gives those agencies 30 days to review the transaction. However, many health care mergers and joint ventures involve smaller entities that fall below that threshold and are thus not reportable under the Act. But given the local nature of competition in this space, some of these transactions can still raise antitrust concerns.

“We are now seeing a significant increase in investigations of non-reportable transactions,” says Shawn Johnson, a partner in Crowell & Moring’s Antitrust Group. “That can raise serious risk for smaller transactions, including acquisitions of hospitals and physician practice groups. Because no notification is required, the deal may close, thus potentially subjecting the buyer to a post hoc legal challenge. There have been several enforcement actions brought in this context, and that is a pretty painful experience for a business to go through.”

Regulators also appear to be closely questioning the justifications parties give for their combinations. For example, health care organizations often point to improved efficiencies as a benefit of the transaction. “The agencies believe that gains in efficiency have to be merger-specific to be credited, which can mean that the benefit could not have resulted from other, less anticompetitive methods,” says Johnson. “Recently, the agencies have aggressively challenged the merger specificity of these benefits in certain cases and questioned whether the parties could generate the same efficiencies through a joint venture or an arm’s-length agreement.”

In one prominent case, the St. Luke’s Health System purchased a nearby physician practice in Idaho in 2012. While the deal was not reportable, the FTC quickly raised questions. The parties argued that the transaction would enable them to coordinate care more closely and increase efficiency. But the FTC challenged the transaction, alleging that a merger wasn’t necessary to coordinate care or achieve the other benefits—and the federal district court agreed. “While the judge recognized the parties’ laudable goals, it found that the proposed transaction was not the only way to achieve them,” says Johnson. In early 2015, the Ninth Circuit court denied St. Luke’s appeal, requiring the hospital to unwind the merger.

“The tensions between an evolving health care industry and antitrust regulation are expected to continue over the coming year—and probably beyond,” says Johnson. “And the FTC and the DOJ have made it clear that they will continue to look closely at competition issues throughout the industry.”

EHR: The next frontier

In health care, the ongoing implementation of electronic health records (EHR) systems holds a great deal of promise in terms of addressing some of the industry’s fundamental challenges. “The idea is that these systems can provide patients with more transparency in terms of the cost and outcomes associated with their care, which can lead to better informed decisions that may also improve their care and potentially reduce health care costs,” says Mason.

But not everyone sees it that way. “The trend toward EHR is generating not only privacy issues but also competitive issues,” says Mason. And regulators are on alert. “The Department of Justice (DOJ) and the Federal Trade Commission (FTC) have said that while they recognize the value of sharing information through EHR, as well as the ACA’s insurance exchanges, they are also going to keep a close eye on these trends to make sure they do not mean reduced competition,” she says.

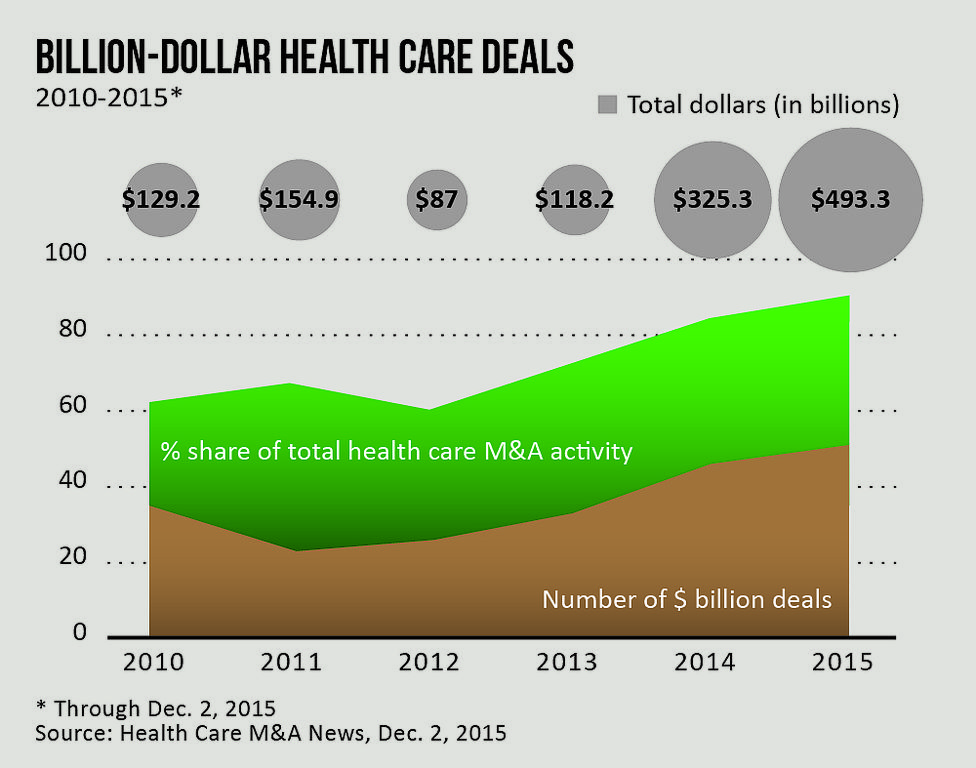

[Not only have the number of billion-dollar health care deals increased dramatically since 2010, but so have the dollar values of these deals and the share of total deals the big deals represent.]

[PDF Download: 2016

|

|

[Web Index: 2016 Regulatory

|

Contacts

Insights

Publication | May 25-27, 2008

“ISI mitigation using bit-edge equalization in high-speed backplane data transmission,” in IEEE International Conference on Communications, Circuits and Systems (ICCCAS 2008), pp. 589 - 593.

Publication | 04.15.24

Publication | 04.10.24

Publication | 2023