Permanent Establishment Risks Arising From Sending Employees to China

Client Alert | 17 min read | 12.28.20

Audits on multinational companies by Chinese tax authorities slowed down during the COVID-19 pandemic and in response to the U.S.-China trade war since 2018 as part of the Chinese government’s tax reduction policy. As the Chinese economy and international travel continue to recover, it is expected that Chinese tax authorities will begin increasing their enforcement actions in 2021 to recover lost tax revenue.

The creation of a permanent establishment (“PE”) by a foreign company is one area ripe for enforcement action by Chinese tax authorities as foreign companies with customers or affiliates in China may not always be aware that a tax presence in China has been created. If the foreign company is deemed by the Chinese tax authorities to have created a PE in China, the foreign company would be liable to pay Chinese enterprise income tax on profits and value added tax on revenue generated from the activities in China.

What is a PE?

A PE is a concept typically defined under the governing bilateral tax agreement between the sending country and the receiving country. For example, Article 5.1 of the United States – The People’s Republic of China Income Tax Convention states that “the term ’permanent establishment’ means a fixed place of business through which the business of an enterprise is wholly or partly carried on.” Article 5.3 provides that a PE can be created through the furnishing of services, including consultancy services, by an enterprise through employees or other personnel engaged for such purpose, but only where such activities continue within China for a period or periods aggregating more than six months within any twelve-month period.

The furnishing of services is defined in the Chinese tax code as activities in construction, technical, management, design, training, consultancy, and other professional services, such as providing technical training, assistance and consultancy services pursuant to a construction project, services in operational management improvements, project feasibility analysis and strategic program design and options for implementation and reform of manufacturing technology, or professional services in enterprise operations and management.

How do PEs arise when a company sends employees to China?

Multinational companies typically send employees to China on extended trips for two primary reasons: (1) for business needs such as to fulfill a customer contract in China; or (2) for talent development or resource needs under which the employee is sent to usually a related subsidiary or affiliate in China on an assignment or secondment arrangement. PE risks can arise under both scenarios.

In a recent case published by China’s State Administration on Taxation, a multinational company that manufactures oil rigs and sold its products to a customer in China was found to have created a PE in China. The payments specified in the contract to be made by the Chinese customer to the foreign vendor included the sale of the product, licensing fees and installation services. During a routine audit of the customer in China, the relevant tax authority discovered that the foreign vendor had been sending engineering staff to China to assist the Chinese customer in the installation, and asked to review entry records at the construction site in China, which showed that the foreign engineers spent more than 183 days in China in one year. Accordingly, the Chinese tax authority determined that the foreign seller had created a PE in China, and was liable for RMB 19,140,000 (about USD 2.9 million) in back taxes and RMB 2,460,000 (about USD 376,000) in late fees.

The above example showcases the unintended creation of a PE by a foreign company under a vendor-customer relationship between unrelated parties when providing after-sales services to a customer in China pursuant to a sales contract under the business needs scenario. A PE can also be created when the foreign company and the Chinese company are related parties, and the foreign company assigns its employees to work in China with a Chinese subsidiary (usually as part of the corporate global mobility program in the talent development scenario mentioned above).

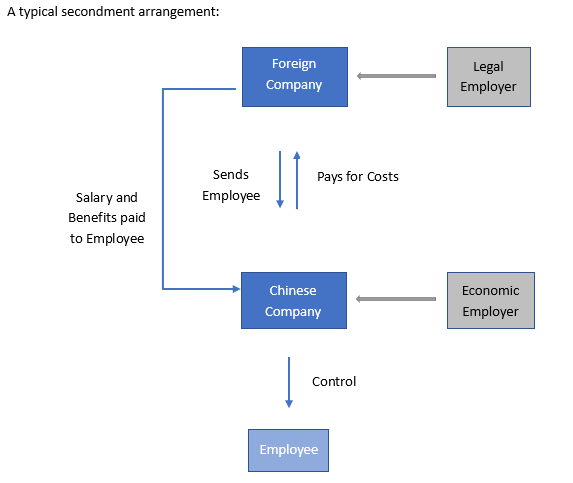

As shown in the diagram below, in a typical secondment arrangement between a foreign company and a Chinese company (usually between related companies), the foreign company sends its employee to China and the Chinese company hosts the employee. The foreign company maintains the employment relationship and employment contract with the employee, and the salary and benefits are paid to the employee by the foreign company. The employee works under the direction and control of the Chinese company during the secondment period. The Chinese company bears the risks and liabilities associated with the work of the assigned employee and ultimately pays for the costs associated with the secondment. Generally, under this type of arrangement, the legal employer is the foreign company, but the economic employer is the Chinese company. In a typical secondment arrangement, the risk of the foreign company being deemed as having created a PE in China is low because the activities of the assigned employee are seen as benefitting the Chinese company.

However, if the secondment does not follow the arrangement as described above and the assignment of an employee from a foreign company to a Chinese company meets one of the following, the Chinese tax authority may determine that the employee is actually working to benefit the foreign company, which means that the PE risk is high:

- The foreign company has the power to direct the work of the foreign employee, and bears the liabilities and risks;

- The foreign company decides how many employees to send to the Chinese company and their qualifications;

- The salary/cost of the employee is borne by the foreign company (not just administering payroll which is fairly common but also be ultimately responsible for the costs of such employee); or

- The foreign company receives profits from the activities engaged in China by the employee sent to the Chinese company.

In short, on the issue of PE with respect to secondment or assignment of personnel by foreign companies, the Chinese tax code adopts the principle of substance over form. The legal employer of the assigned employee can be the foreign company, but as long as the economic employer is the Chinese company, the risk of PE is low. In contrast, the risk of PE increases if both the legal employer and the economic employer are the foreign company.

What can multinational companies do to mitigate the risks, including PE, when sending employees to China?

As indicated above, potential liabilities arising from the unintended creation of a PE in China can be high. However, the creation of a PE is not the only risk when multinational companies send employees to China. Risks can also arise in other contexts such as employment, data privacy, and immigration, which are subjects of other articles.

Considering the PE and other risks, under the business needs scenario, it is important for companies to do the following when sending employees to China, especially if the trip is more than what can normally be considered as a short business trip:

- Engage the relevant internal stakeholders, such as contracts, tax/finance, legal and HR to set parameters so that the contractual obligations or proposed business activities to be performed in China do not create a PE or incur other unnecessary risks for the company (including tax, employment, data privacy, etc.). The parameters may include the time the employee should spend in China, the types of work that can be done in China based on the allocation of liabilities and costs under the contract, the people with whom the employee may interact or to whom the employee should report.

- Communicate the parameters clearly to the employee before the trip, and monitor the business activities of the employee to make sure that the parameters are being followed.

- Understand the immigration requirements. Questions may arise as to whether a work visa is needed and which entity should sponsor the work visa for the employee, the local customer or a local affiliate.

Under the secondment and expat assignment scenario, multinational companies should take the following steps for risk mitigation when sending an employee on a secondment/assignment to work in China:

- Review the relevant agreements in place between the relevant companies to ensure that they contain terms that properly allocate the companies’ rights and obligations consistent with PE risk consideration. This includes a service/dispatch agreement between the foreign sending company and the Chinese host company, recharge/payment provisions from the Chinese host company to the foreign company to cover the costs of those seconded to work in China, and control and liability provisions relating to the work performed by the assigned employees.

- Ensure that the seconded employees have documents prepared that properly reflect their status in China. The employees should be issued an assignment letter and consent to the arrangement, and should avoid signing a local Chinese employment contract, even just for the purpose of applying for the PRC work permit (local authorities in top tier cities in China generally would not require a local employment contract to issue a PRC work permit).

- Note the statutory requirements applicable to expatriates who are assigned to work in China (e.g. work permit, personal income tax, social insurance and work conditions), even if such expatriates are employed by the overseas entity. For example, expatriates are subject to the minimum legal and labor requirements under Article 21 and 22 of the Administrative Provisions on Employment of Foreigners in China which were amended by the Ministry of Human Resources and Social Security on March 13, 2017.

Contacts

Insights

Client Alert | 3 min read | 04.22.24

In the latest sign that federal enforcers remain focused on increasing antitrust enforcement, last Thursday, the Justice Department (DOJ), Federal Trade Commission (FTC) and the Department of Health and Human Services (HHS) revealed an online portal, HealthyCompetition.gov, to encourage the public to submit reports on potential anticompetitive and monopolistic conduct in the healthcare sector. The initiative seeks to address concerns that such behavior may affect healthcare affordability and quality, and employee wages.

Client Alert | 1 min read | 04.18.24

GSA Clarifies Permissibility of Upfront Payments for Software-as-a-Service Offerings

Client Alert | 4 min read | 04.18.24

Client Alert | 6 min read | 04.16.24

Navigating the AI Intellectual Property Maze - Key Points From Congressional Hearing