Medicare Quality Payment Program: Alternative Payment Models (APMs)

Client Alert | 40 min read | 07.25.16

The Medicare Access and CHIP Reauthorization Act (MACRA), enacted in April 2015, authorized the creation of the Medicare Quality Payment Program. Among other changes, MACRA provides for rewards for participation in Alternative Payment Models (APMs) to promote high-value rather than high-volume care. On May 9, 2016, the Centers for Medicare and Medicaid Services (CMS) published a notice of proposed rulemaking in the federal register to implement MACRA by creating the Quality Payment Program (MACRA Rule).

In this second installment in our series of alerts on the MACRA Rule, we discuss the role of APMs under the Quality Payment Program. The first installment is available here.

A. Purpose of APM Incentives

Although most clinicians will be subject to MIPS, clinicians who participate in Advanced Alternative Payment Models (APMs) may earn additional incentives.

In the preamble to the MACRA Rule, CMS explained that the “core policy principles” for promotion of APM use are “derived from both the MACRA and the Department’s broad vision for better care, smarter spending, and healthier people.” CMS specifically intends to use this proposed payment model to continue to promote the growth of APMs that allow participation for a broad range of physicians.

The proposed payment regime would reward physicians in two separate, mutually-exclusive ways for participating in APMs. First, Qualifying APM Participants, as described below, will be eligible to receive an APM incentive payment each year. Second, MIPS physicians who participate in APMs but are not Qualifying APM Participants may earn a higher score for the Clinical Practice Improvement Activities MIPS category. The Clinical Practice Improvement Activities (CPIAs) Category constitutes 15 percent of composite performance score of MIPS, which are discussed in "MACRA and MIPS: The Basics and Beyond."

B. APM Requirements to Create Incentive Payments for Participants

MACRA defines an APM as an innovative model under section 1115A of the Social Security Act, the Shared Savings Program, or a demonstration as defined by other federal law. Examples of APMs include Accountable Care Organizations (ACOs), Patient Centered Medical Homes, and bundled payment models.

MACRA does not change how any particular APM functions or rewards value. Rather, it creates extra incentives for APM participation. Qualifying APM Participants can earn additional incentive payments for participation if they become Advanced APMs or Other Payer Advanced APMs. Advanced APMs must meet three requirements:

- First, Advanced APMs must require at least 50 percent of the eligible clinicians to use EHR technology to document and communicate clinical care. This threshold will increase to 75 percent after the first year.

- Second, Advanced APMs must provide payment based on quality measures comparable to those under the proposed annual list of MIPS quality performance measures. As noted in "MACRA and MIPS: The Basics and Beyond," the quality performance category replaces the current Physician Quality Reporting System (PQRS) and borrows some reporting measures from the Physician Value-Based Payment Modifier (VBM) program. Comparable to MIPS is defined to mean any actual measures that applies to MIPS or other measures that are determined to be evidence-based, reliable and valid.

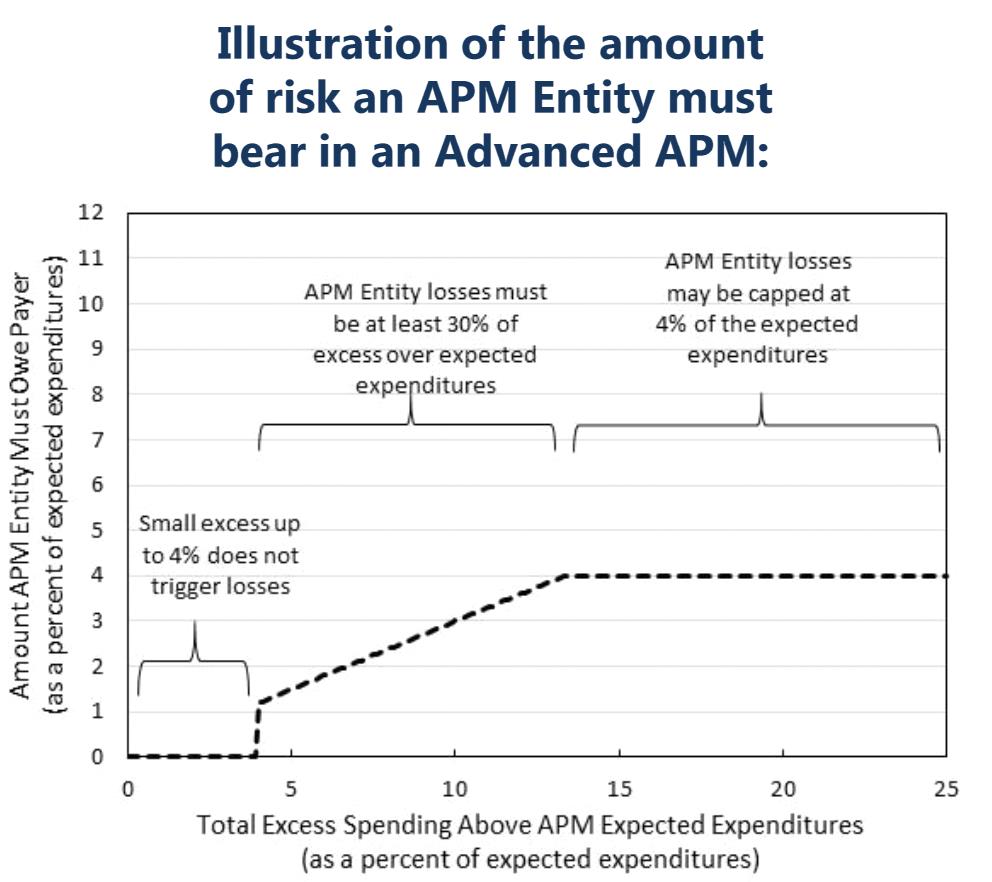

- Finally, Advanced APMs must also bear financial risk of monetary loss on the provision of services that is of a certain magnitude. Generally, the total amount of risk for APMs must be at least four percent of expected expenditures, marginal risk of at least 30 percent with a minimum loss ratio of no more than four percent. (Note that the risk criterion for Medical Home Model entities differ from those of other APMs.) The following CMS graph illustrates the risk threshold:

Similarly, Other Payer APMs (certain arrangements in which eligible clinicians may participate through other payers) must meet similar criteria to qualify for incentives as Other Payer Advanced APMs.

CMS will post the names of all APMs that qualify as Advanced APMs on its website at the beginning of each performance period.

C. How Does a Clinician Qualify for APM Incentives?

Under the MACRA Rule, APM incentives would be available to Qualifying APM Participants (QPs).

A QP is a MIPS-eligible clinician or an APM Entity group that CMS has determined has met or exceeded an applicable threshold of participation in one or more Advanced APMs. QPs will be excluded from MIPS and will receive an annual lump sum bonus as explained in Section D.

The applicable threshold differs based on several factors. First, a clinician’s or group’s threshold may be met for Medicare Part B services only or, in and after 2021, for services covered by all payers. Under the Medicare-only option, the threshold may be met with as little as 20 percent of patients or 25 percent of payments being attributable to an APM for the clinician or group to be a QP. For the all-payer option, the clinician or group would be required to meet both an all-payer threshold and a lower Medicare-only threshold. Second, thresholds will rise incrementally from 2019 to 2023 to encourage increased uptake of APMs over time. Finally, CMS would determine whether a clinician or group is a QP by applying the higher of the clinician’s or group’s payment amount or its patient count. CMS proposes to determine each clinician’s or group’s payment amount percentage by dividing the aggregate amount of payments for services furnished to attributed beneficiaries over the aggregate amount of payments for services furnished to all “attribution-eligible” beneficiaries. Similarly, to determine patient count percentage, CMS would use a numerator of the total number of attributed beneficiaries and a denominator of attribution-eligible beneficiaries.

The following table indicates the applicable thresholds:

| Payment Year | Medicare Option | All-Payer Combination Option |

| 2019 – 2020 | Payment Amount: 25% | The All-Payer Combination Option is not available until payment year 2021. |

| Patient Count: 20% | ||

| 2021 – 2022 | Payment Amount: 50% | Payment Amount: 50% In addition to the 50% All-Payer threshold, the clinician/group must meet a 25% Medicare payment threshold. |

| Patient Count: 35% | Patient Count: 35% In addition to the 35% All-Payer threshold, the clinician/group must meet a 20% Medicare patient threshold. |

|

| 2023 and subsequent years | Payment Amount: 75% | Payment Amount: 75% In addition to the 75% All-Payer threshold, the clinician/group must meet a 25% Medicare payment threshold. |

| Patient Count: 50% | Patient Count: 50% In addition to the 50% All-Payer threshold, the clinician/group must meet a 20% Medicare patient threshold. |

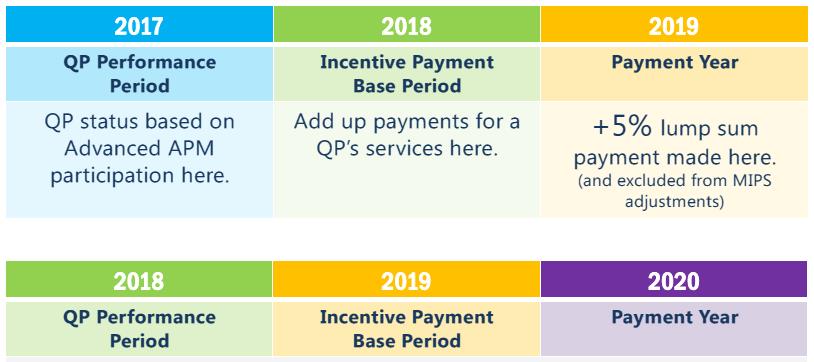

CMS will determine whether a clinician or group is a QP based on the payment amount or patient count from the calendar year two years prior to each payment year. Beginning with payment year 2019, CMS will base its determination on performance data from 2017. CMS’s proposed timetable for QP determination and APM incentive payments is provided below:

D. How Does Payment under an APM Differ from Payment under MIPS?

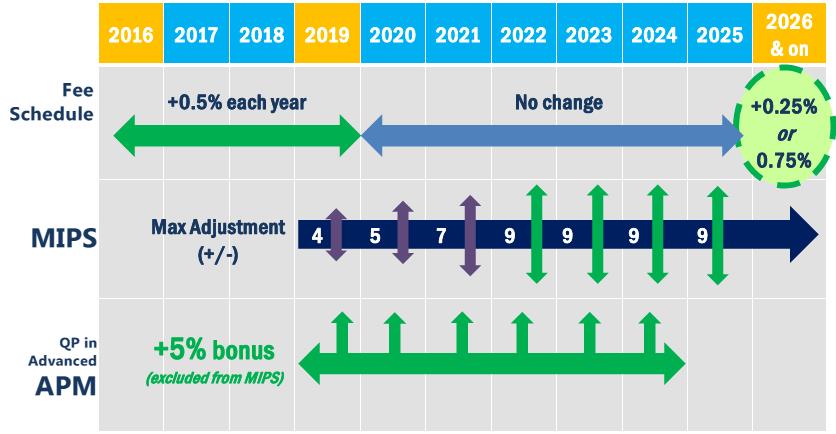

Physicians who participate in APMs will benefit from the MACRA payment system in two separate ways. First, from 2019 through 2024, physicians participating in an Advanced APM will receive an incentive payment equal to five percent of the aggregate amount of services paid under the physician fee schedule (PFS) during the year. Then, beginning in 2026, PFS rates for physicians participating in APMs will increase by 0.75 percent per year, three times the level rates will rise for other physicians.

As we discussed in "MACRA and MIPS: The Basics and Beyond," MIPS eligible clinicians may be subject to upward or downward payment adjustments. Although participation in an Advanced APM itself subjects a QP to some financial risk, the five percent incentive for QPs is always a bonus. The following CMS chart illustrates the financial incentives available to QPs compared to MIPS eligible clinicians:

These APM-triggered rewards would be available to a QP in addition to any shared savings or other financial incentives directly tied to the QP’s participation in the APM. The proposed regulation clarifies that “APM Incentive Payments made under this section are not included in determining actual expenditures under an APM.” That is, the five percent incentive would not be calculated by CMS as an additional charge by the QP under the PFS. For example, if a QP is an Accountable Care Organization (ACO) professional under the Medicare Shared Savings Program (MSSP), the QP’s five percent incentive payment would not be incorporated into his or her ACO’s assigned beneficiary expenditures, and therefore would not impact the ACO’s savings or losses.

CMS will perform monitoring and compliance around the APM incentive payments.

E. Legal Counsel in New Landscape

MACRA and the proposed MACRA Rule set forth a phased implementation process over the next ten years. But clinicians’ and groups’ performance beginning in calendar year 2017 would impact payment adjustments and set bonus structures under both MIPS and APMs. Stakeholders should continue to review new development and guidance from CMS and begin strategizing innovative ways to participate in the APM incentive payments. Among others, the following issues may be informed by regulatory healthcare expertise:

- Are you practicing in an APM? Will your APM be able to participate as an Advanced APM?

- If you are thinking about participating in an APM, which model is the best fit? Will your participation be focused on Medicare or will it include Medicaid and other payers?

- What health care regulatory and privacy concerns should be considered in moving towards the use of EHR technology to document and communicate clinical care?

- Will restructuring your IPA or provider organization implicate the state insurance regulatory scheme? Will you require regulatory licensure or certification?

- Would modifications to existing payment arrangements raise fraud and abuse concerns? Will there be any corporate practices concerns?

Sound expertise in corporate transactions, health care fraud and abuse, and other applicable regulatory restrictions may be helpful in understanding the opportunities and legal risks associated with participation in the new MACRA payment systems.

Insights

Client Alert | 1 min read | 04.18.24

GSA Clarifies Permissibility of Upfront Payments for Software-as-a-Service Offerings

On March 15, 2024, the General Services Administration (GSA) issued Acquisition Letter MV-2024-01 providing guidance to GSA contracting officers on the use of upfront payments for acquisitions of cloud-based Software-as-a-Service (SaaS). Specifically, this acquisition letter clarifies that despite statutory prohibitions against the use of “advance” payments outside of narrowly-prescribed circumstances, upfront payments for SaaS licenses do not constitute an “advance” payment subject to these restrictions when made under the following conditions:

Client Alert | 4 min read | 04.18.24

Client Alert | 6 min read | 04.16.24

Navigating the AI Intellectual Property Maze - Key Points From Congressional Hearing

Client Alert | 5 min read | 04.15.24

Making the EU Courts More Efficient for Trade-Related Decisions